June 19, 2018

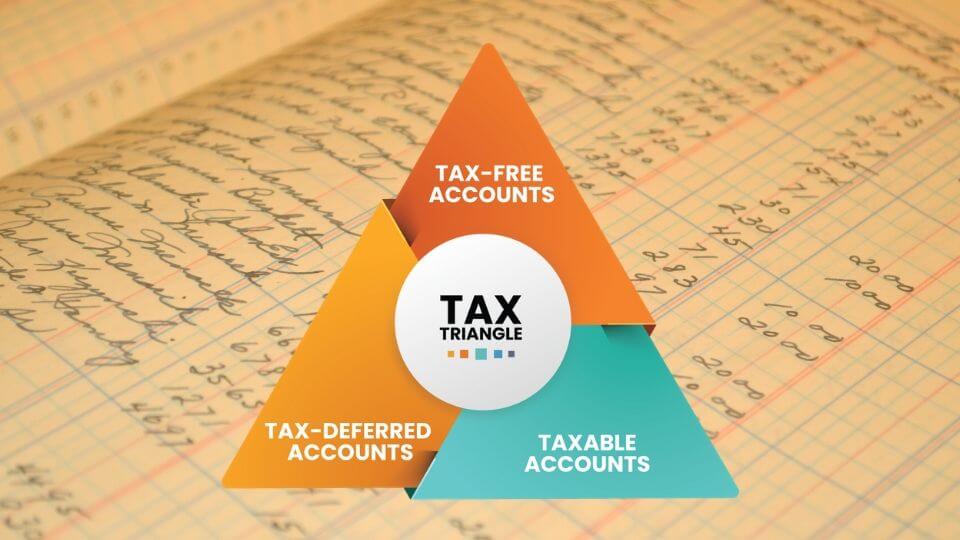

If selling your house is in the near future, you must keep a few things to keep in mind. For example, the sale of your home could put you in another tax bracket, that is unless you also qualify to exclude all or part of the income from the sale. Below, are tax tips you need to know when you sell your home: