Why Your Business Will Never Sell

July 5, 2017

What is a CEPA and the Reason I Became One?

August 3, 2017The Four C’s – the Intangible Assets that Drive REAL Value to a Business

Being a small business owner means you work hard to increase your bottom line and drive income into your pocket. The problem with that is most owners forget that a strong bottom line is only a small part of the value of a business. You MUST be working on both. So, what actually makes a business valuable to potential buyers?

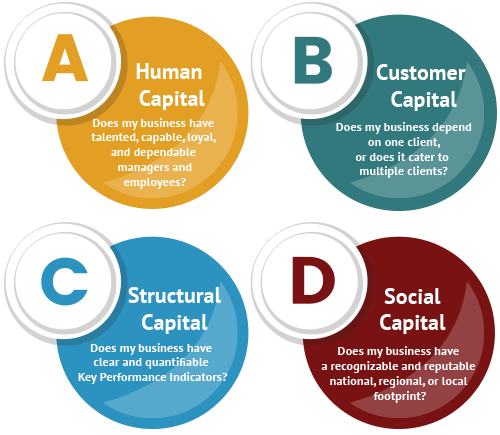

In order to actually figure out the value of your business, there are few factors that increase the multiple or valuation. One of those factors is the tangible assets – the desks, computers, equipment, etc. However, most, if not all, of the business value is incorporated into intangible assets. The Exit Planning Institute states as much as 80% of the value of the business could be wrapped up in intangible assets. They put together four “C’s”, which are four different types of capital, that actually drive up the value of the business.

#1 C: Human Capital

These are your team players; your executives and employees. There are several things to consider here. Look at how they’re positioned. Are they close to the same age as the potential buyer? Do they plan to retire soon? Do they have good credentials? How much experience are they bringing to the field? Think about a football team. There are eleven players actively playing the game for a team at any given time, whether it is on offense or defense. However, the bench boasts 50-100 more players that can rotate in and out. Typically, the team has more than one quarterback, possibly even three or four backups. There are multiple running backs, receivers and so on. The same analogy is applicable to business. When it comes to human capital, if the whole business revolves around you, the business owner, then your business’s buyer will likely be concerned. And concern means a lower value for your business. So position yourself with team players that can carry the load long after you’re gone.

#2 C: Customer Capital

Many times, businesses try to diversify the customer base. The stronger, more diversified their base, the higher the value. For instance, right now, I have a client trying to sell his business and he has one customer. The problem? If that one customer leaves, the potential buyer of that business could end up destitute. Build it (your customer base) and they (the buyers) will come!! The capital in this one area could pay dividends in upping your business’s multiple.

#3 C: Structural Capital

The structural capital focuses on how your business operates. Are there processes in place that allows a buyer to step in seamlessly when you step out? Will the buyer know how to handle the business operations? If you’re in manufacturing, are there guide books or instructions for manufacturing products? Or if sales are your domain, is there lists or systems to manage your clients? Could a new sales team come right in with little to no problem? Make sure when you leave, your business is structured in a way that the new owner experiences a smooth transition.

#4 C: Social Capital

Social capital is a relatively new concept. It revolves around the notion of how your business is perceived in the community. Does it have a good reputation or a poor one? In recent years, national publicly traded companies with bad publicity ended up with plummeting stocks. For instance, when BP’s (British Petroleum) oil tankers had issues in the Gulf of Mexico. It was horrific and tragic. We watched as the oil slicks harmed animal life and property at the beaches. The social capital for BP during that time was definitely negatively affected. However, they rebounded and turned things around in this area. For a privately traded company or a small business, you might not be as lucky. Negative press about your business creates a bad impression for potential buyers and that drops its value.

What Does This Mean for You

It is paramount to remember what often drives your business’ value are the intangible assets. These four “C’s” could contribute three to four times more than the tangible assets. So, it’s vital, as a business owner, to focus on building these areas more than the tangible areas if you plan to sell your business one day (and you should be).

To learn more about how intangible and tangible assets help grow your business, visit our Building a Sellable Business series. It will teach you these and many other topics that make your company more attractive to the business-buyers when you are ready to retire.