How Much Should a Business Owner Pay for a House?

July 9, 2019

Captive vs Independent Insurance Agent – Who Saves You More Money?

July 16, 2019What Type of Mortgage Should a Business Owner Have on a House?

Since becoming a CERTIFIED FINANCIAL PLANNER™ in 2006, I’ve worked with hundreds, possibly thousands, of business owners. Eventually, their questions start to sound familiar, especially when they start asking me about their home mortgages. I’ve heard, “Justin, how much should I put down on my house?”. Others ask, “Hey Justin, should I finance 100% of my mortgage or not?”. Similarly, other clients ask, “Justin, should I move the equity from my current house to my next house?”, or “Is it better for me to take out a 15-year mortgage or a 30-year mortgage?”. Whether my clients are asking me about ARM loans, balloon notes, down payments, mortgage terms or the like, they’re all asking me the same basic question. What type of mortgage should a business owner have on a house?

TIME INDEX:

- 01:06 – What Type of Mortgage Should a Business Owner Have?

- 01:43 – Some Simple Education

- 02:32 – The House Doesn’t Care if You Have a Mortgage or Not

- 04:29 – If the House Appreciates in Value, You are Going to Build Equity

- 05:38 – The Interest Rate on a Mortgage is Usually Some of the Cheapest Money You have Access to

- 08:44 – Mortgage Payments Get Easier Over Time

- 11:09 – Large Mortgages Let You Invest More Money Faster

- 12:31 – Example #1

- 15:25 – Example #2

- 18:12 – A Large Mortgage Can Create the Opportunity to Build More Wealth

- 20:49 – Having a Mortgage Will Give You More Flexibility and More Liquidity

- 22:58 – You May Qualify for a Tax Deduction

- 23:13 – Summary

Facts About Home Ownership

In order to answer the question, “What type of mortgage should a business owner have on a house?”, I need to give you some rudimentary financial education. You need a list of facts about homeownership. After you stack each of the following points on top of one another, you’ll understand how I arrived at my answer to the question.

#1 – You are anticipating that the house will appreciate in value.

For the purposes of this article, we’re going to call your house an asset, and we’re going to define an asset as something that appreciates in value over time. When you buy a house, you believe that its value will increase or you wouldn’t have bought it. If you didn’t see any value in the house, you probably would have just rented it from a landlord. Thus, whether you paid $100,000 or $1 million for your house, you’re anticipating a return on your investment.

Your anticipated return on investment is a relatively sound one, too. Historically, houses have appreciated at a yearly rate of three to five percent depending on which sources you read. However, there have been times when houses have not appreciated in a year. I think specifically of the years 2007 to 2009. During that time period, house values experienced the same downturn the stock market experienced (if not a greater one). Yet typically, residential real estate – single-family houses, attached houses, townhouses, condominiums – will appreciate in value.

#2 – The house will appreciate (or depreciate) in value regardless of how much you owe on it.

Let’s also recognize the fact that the house will appreciate (or even depreciate) in value with or without a mortgage placed on it. The house doesn’t care if there’s a 10-year mortgage, a 15-year mortgage, a 30-year mortgage, or an Adjustable Rate Mortgage on it. It doesn’t care if you paid 100% down or if you paid $0 down. The house will appreciate (or depreciate) in value according to market trends, geographic location, economic stability or instability, and homeowner renovations, not according to the amount of debt you owe on it.

#3 – IF the house is going to appreciate in value, you’re going to build equity.

Another indisputable fact is that IF the house is going to appreciate in value, you’re going to build equity. That’s common sense, right? If the idea is that you need equity in your house, then the house will (by virtue of the asset) generate its own equity over time. If it wasn’t capable of generating its own equity, then you shouldn’t have bought it.

Go back to point number one. You are anticipating, as well as I am, that the residential real estate you have purchased will appreciate over time. It doesn’t do you any good to take as much cash as possible as quickly as possible and put it on your house just so you can build equity. The house will do that on its own over time.

#4 – The interest rate on the mortgage is usually the cheapest money you can access.

For a mortgage in the United States right now, you can secure rates in the 2% to 6% range, with the majority falling between 4% or 5%. Now, there have been times when mortgages were in the high teens, but relatively speaking mortgages are typically some of the cheapest money you can access. Let me explain.

At the same time mortgages are falling between that 2% to 6% range, credit card interest rates are falling between 14% and 24%. Of course, there are some credit cards offering an introductory rate of 0%, and there are some people with exceptional credit who can get a 6% or 7% interest rate, but for the most part, credit card interest rates are significantly higher than mortgage interest rates. And honestly, you’re not going to use a credit card to purchase a house. It’s not going to happen.

Additionally, while mortgages rates are falling between 2% and 6%, market investments (one could argue) are generating rates of return between 6% and 12%. I personally believe that a 6% to 8% equity return is fair, but I’ve heard some in the Internet world and in the mass media who pronounce 10% to 12% returns as possible and probable for a long-term investment. I know the S&P 500 has yielded a return of almost 10% at this particular point long-term, so I realize that investments can yield a variety of rates. For the most part, though, we can make a reasonable assumption that your investments can yield between 6% to 8%.

That means, if you can borrow money at 6% (the high rate on the mortgage) and invest money in the stock market and get an 8% to 10% rate of return, then a mortgage is truly some of the cheapest money you can access.

#5 – Mortgage payments get easier over time.

Another fact about home buying is that mortgage payments get easier over time. In a vacuum, you might think, “My goodness, my mortgage is going to be x number of thousands per month.” Yet, over time inflation becomes a friend. In fact, in my YouTube video, The Million Dollar Difference, I reflect on how a monthly mortgage payment of $1,193 today will feel like $970 in 10 years’ time. After 20 years, it will only feel like $758, and amazingly, after 30 years, it will feel like $536. I actually have clients who laugh at their ridiculously low house payments. They’ve been living in their house now for 20 or 30 years, and they laugh about how monstrous their $200 – $400 monthly mortgage payment seemed when they purchased the house.

Now, if mortgage payments get easier over time, then the opposite would be true – your income should increase over time. Thus, assuming basic inflation rates hold steady, $1193 today would be roughly $1459 in 10 years, and after 20 years, it would be $1856. You just received a pay increase of almost $700 over a 20 year period of time just from cost-of-living adjustments. And amazingly, after 30 years your current income would be almost $1400 more a month, coming in at roughly $2648. Thus, your mortgage payments get easier over time.

#6 – Large mortgages let you invest more money faster.

Now, here’s where I think it gets fun. Large mortgages let you invest more money faster.

A client of mine recently came to me with the following situation. “Justin, my wife and I are ready to upgrade our house. Our current house is worth $425,000, and we have $75,000 of debt on it. We want to buy a $600,000 house. How do we do it?” Currently, this business owner has a current net worth of about $2 million and based on his income and assets, he can definitely afford a $600,000 house. He will also have $350,000 in equity (cash from the sale of the house) that he can put down onto the new house. Yet, should he put down the entire $350,000 on the new house and get a mortgage for the remaining balance? That’s a common piece of advice I’ve heard over the years from financial individuals. Maybe, there’s even a time when that would make sense, but mathematically, here are the numbers.

Example #1

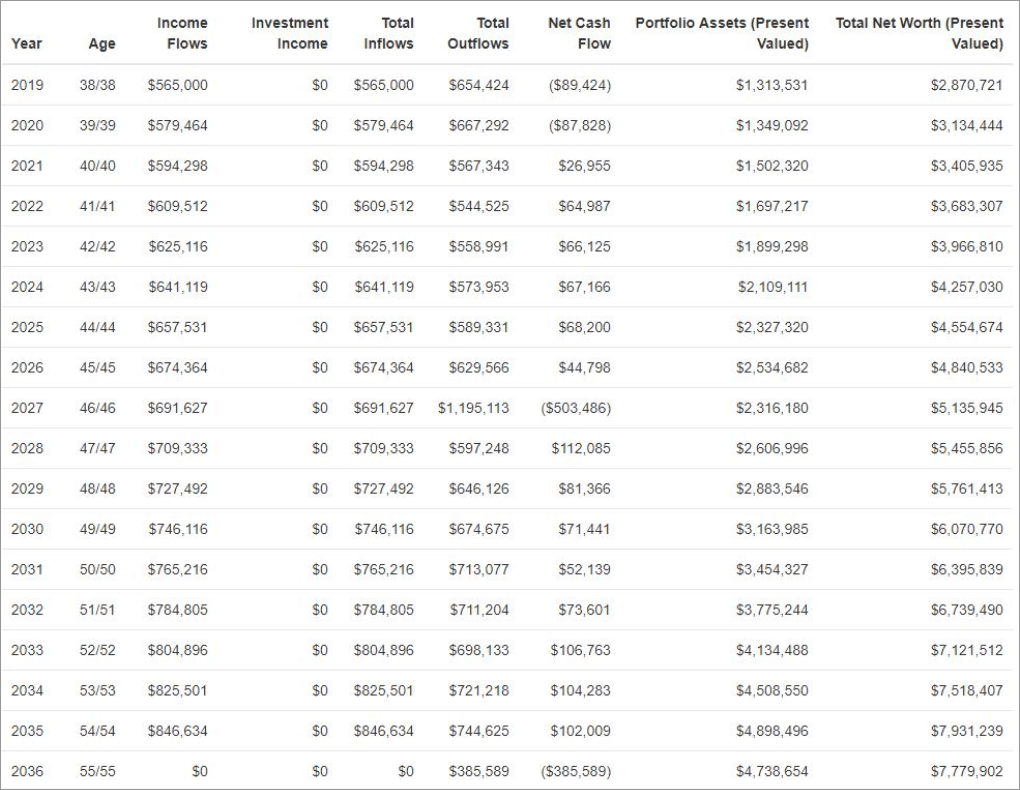

If my client took the $350,000 of equity and applied it to a $600,000 house, he would have a mortgage of roughly $250,000, plus or minus some closings costs. With a 30-year fixed mortgage at a 5% interest rate, his monthly payment would be roughly $1,342. Well, my client is 38-years-old, and he wants to retire at age 54 and travel the world. Assuming he retires at age 54, we anticipate he’ll have an accumulated net worth of $7,779,000. So after 17 years, his portfolio value will be almost $4.8 million. After 30 years, whenever he’s 78-years-old, his net worth will be $5.2 million. No bad.

Example #2

What happens, though, if my client does something different? Instead of taking all of the equity from the first house and rolling it into the second house, what if he only put down $120,000, or 20%? That, at least, prevents him from paying mortgage insurance. Let’s say he puts $120,000 down on the house and invests the remaining $230,000. If he does that, by the time he’s 54-years-old, our software projects that he will have a net worth of $8,249,000. That’s almost $200,000 more than if he put all of his equity into the new house. More astounding is that after 30 years, instead of having $5.25 million in net worth, he’d have $5.83 million in disposable assets if he didn’t roll all his equity into the new house.

#7 – A large mortgage can create opportunity for you to build more wealth.

Just in case you aren’t following me, let me drive these points home. A large mortgage can create an opportunity for you to build more wealth. It does this by creating a spread between your potential asset growth rates and your liability growth rates which help you increase your wealth.

Here’s the reality. We know a house doesn’t appreciate any more or less if it has debt on it or if it doesn’t. If my client purchased the $600,000 house, it could likely appreciate in value 3% per year. Thus, it will earn roughly $18,000 a year, with or without a mortgage.

In the very first year, then, if my client buys that $600,000 house and takes out a mortgage of $480,000 at a 5% interest rate, then his principal and interest payments will be $24,000. Yet, the house only appreciates in value by $18,000. In theory, my client’s losing $6,000 in year one. But if he puts $230,000 into an investment account that makes an 8% return, he will gain $18,400 in net worth. That gives him a net gain of $12,400.

However, as I mentioned in point number four, inflation can benefit you greatly. After 17 years of these mathematical calculations, the business owner’s net worth would be $334,000 greater than it would be if he took the entire $350,000 from the sale of his first house and put it toward the purchase of his new house. After 30 years, he’d have $574,000 more net worth.

#8 – Having a large mortgage gives you more flexibility and more liquidity.

Not only does having a large mortgage create opportunities for you to build more wealth and to build it quickly, it gives you more flexibility and liquidity.

As I’ve already mentioned, the stock market and the housing market started to fall in 2007. At that time, my wife and I had our house paid-in-full. We were sitting on about $300,000 of assets in addition to that paid-for house. In 2007, we used a Home Equity Line of Credit to go in and borrow all the equity out of our house because I wanted to have some flexibility. That left us sitting on about $500,000 in liquid assets.

In 2008 and 2009, the market fell drastically as did income for financial planners. Then, in 2009 I began dealing with a lawsuit. Had my house been paid for, there would have been no assets whatsoever that I could have used to deal with that lawsuit. I couldn’t have presented my case, or at least I couldn’t have presented it well.

Having cash on hand is key. Yet those who place a significant amount of money down on their house, can’t get to the money whenever life happens. They would have to sell the house or refinance it. And if you lose a job, banks aren’t likely to loan you money to refinance your house. If you have an existing mortgage, though, banks might work with you and lower your monthly payments while you’re looking for a new job or while you’re getting your life back together.

#9 – The interest on your house could be tax-deductible

The final home buying fact I want you to understand is that homeowners may qualify for tax deductions. In 2019, the standard tax deduction is $24,400 on Schedule A. However, if you are able to itemize and take more than the standard tax deduction, the interest you pay on your home mortgage would count toward your tax deductions.

What Type of Mortgage Should a Business Owner Have on a House?

Ultimately, then, what’s the answer to the question? What type of mortgage should a business owner have on a house? I personally think you need to have the largest mortgage possible at the longest duration possible on a house that costs less than the bank says you can afford.

Go back to my last article. I showed you that if you buy a house that breaks your monthly budget, you’ll never be able to live comfortably or save and invest. You’ll be so consumed with mortgage payments that you’ll not be able to reach other financial dreams and desires. First, then, buy a house priced below what the bank says you can afford.

Then, take out a mortgage for as much of the house’s value as you can and for the longest period of time that you can. Personally, I like a 30-year fixed mortgage. I think it’s competitive and fair. I realize there are some 40-year mortgages out there now, but I like the 30-year mortgage. I’m not really a fan of Adjustable Rate Mortgages or of 15-year mortgages because the math doesn’t support them.

At this point, if you fall into a certain camp of certain radio personalities, you may say, “Justin, you’re off your rocker. Have you heard this? Haven’t you heard that?” Look, I understand all the arguments. I’ve read every book out there on the subject, and I also do this on a daily basis for clients. I’m not allowed to give my personal opinion when it relates to a client’s factual matters. I wish I could, but I can’t. However, this is a fact. The facts state that if you carry a large mortgage with the lowest down payment possible, you have the ability to build net worth faster. Hands down. So my answer to the question – What type of mortgage should a business owner have on a house? – is this. The largest and the longest possible.

This article is part of the Cash Flow area of our ever-expanding series: Personal Finance for Business Owners. Expand your wealth-building knowledge by heading over today!