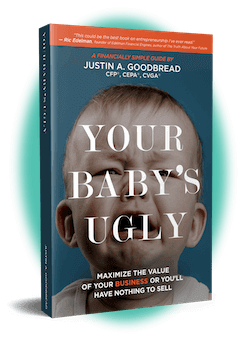

Helping thousands like you grow their businesses to their maximum value.

AMAZON #1 NEW RELEASE

You built your business into something you are proud of. But is it as valuable as you think to its future buyer? How do you know? In Your Baby's Ugly, award-winning Certified Value Growth Advisor Justin Goodbread guides you through benchmarks that help you determine its real value and areas that boost attractiveness.