Garrison Keillor once said, “A book is a gift you can open again and again.” The great thing about business books is that the gifts within them can be life-changing for you, your business, and all the lives impacted as a result. The Financially Simple team understands this concept well and we love to share the books Justin reads—some on an annual basis, and others for the first time.

If you have a great book you think we would like, i.e. must read, let us know (if you’re suggesting your own book, please visit this page).

The Business/Financial Book of the Month

Our Pick for January 2024:

This expanded edition of The Go-Giver includes the text of the original business parable, together with a foreword by Arianna Huffington, a new introduction, a discussion guide, and a Q&A with the authors.

This expanded edition of The Go-Giver includes the text of the original business parable, together with a foreword by Arianna Huffington, a new introduction, a discussion guide, and a Q&A with the authors.

The Go-Giver tells the story of an ambitious young man named Joe who yearns for success. Joe is a true go-getter, though sometimes he feels as if the harder and faster he works, the further away his goals seem to be. Desperate to land a key sale at the end of a bad quarter, he seeks advice from the enigmatic Pindar, a legendary consultant referred to by his many devotees simply as the Chairman.

Imparted with wit and grace, The Go-Giver is a classic bestseller that brings to life the old proverb “Give and you shall receive.” Since its original publication, the term “go-giver” has become shorthand for a defining set of values embraced by hundreds of thousands of people around the world. Today this timeless story continues to help its readers find fulfillment and greater business success, in their personal lives, and their communities.

Get your copy of The Go-Giver, Expanded Edition: A Little Story About a Powerful Business Idea by Bob Burg and John David Mann, today!

Financially Simple Guides

Your Baby’s Ugly: Maximize the Value of Your Business or You’ll Have Nothing to Sell by Justin Goodbread

The second book in author Justin Goodbread’s Financially Simple Business Series, Your Baby’s Ugly: Maximize the Value of your Business or You’ll Have Nothing to Sell, teaches small business owners, like yourself, to honestly evaluate the sellable value of their business. It dives into the eight key areas appraisers use to determine if a business is best-in-class. For example, you can use the same methodology to evaluate whether your operational systems are causing money-wasting inefficiencies, or to measure how your personal values contribute to (or harm) your team and its marketing efforts.

If you have no plans to sell any time soon, Your Baby’s Ugly can add stability and direction for your team and even lowered stress for you while also making your “baby” more beautiful for the day you do decide to transition out.

Is this review a shameless plug? Probably. Are we confident that Your Baby’s Ugly will change business owners’ lives? Absolutely!

Previous Books of the Month

The biggest problem that most entrepreneurs have isn’t creating an amazing product or service; it’s getting their future customers to discover that they even exist. Every year, tens of thousands of businesses start and fail because the entrepreneurs don’t understand this one essential skill: the art and science of getting traffic (or people) to find you. And that is a tragedy.

The biggest problem that most entrepreneurs have isn’t creating an amazing product or service; it’s getting their future customers to discover that they even exist. Every year, tens of thousands of businesses start and fail because the entrepreneurs don’t understand this one essential skill: the art and science of getting traffic (or people) to find you. And that is a tragedy.

Traffic Secrets was written to help you get your message out to the world about your products and services. I strongly believe that entrepreneurs are the only people on earth who can actually change the world. It won’t happen in government, and I don’t think it will happen in schools.

It’ll happen because of entrepreneurs like you, who are crazy enough to build products and services that will actually change the world. It’ll happen because we are crazy enough to risk everything to try and make that dream become a reality.

To all the entrepreneurs who fail in their first year of business, what a tragedy it is when the one thing they risked everything for never fully gets to see the light of day. Waiting for people to come to you is not a strategy. Understanding exactly WHO your dream customer is, discovering where they’re congregating, and throwing out the hooks that will grab their attention to pull them into your funnels (where you can tell them a story and make them an offer) is the strategy. That’s the big secret.

Traffic is just people. This book will help you find YOUR people, so you can focus on changing their world with the products and services that you sell.

Get your copy of Trade Secrets: The Underground Playbook for Filling Your Websites and Funnels With Your Dream Customers by Russel Brunson, today!

Think Big, Act Small: How America’s Performing Companies Keep the Start-up Spirit Alive by Jason Jennings

Tradition says there are three ways to grow a company’s profits: Fire up the sales team with empty promises, cut costs and downsize, or cook the books. But what if there’s a better way—a way that nine amazingly profitable and well-run companies are already embracing?

Tradition says there are three ways to grow a company’s profits: Fire up the sales team with empty promises, cut costs and downsize, or cook the books. But what if there’s a better way—a way that nine amazingly profitable and well-run companies are already embracing?

Jason Jennings and his research team screened more than 100,000 American companies to find nine that rarely end up on magazine covers, yet have increased revenues and profits by ten percent or more for ten consecutive years. Then they interviewed the leaders, workers, and customers of these quiet superstars to find the secrets of their astoundingly consistent and profitable growth.

What they have in common is a culture—a community—based on a shockingly simple precept: Think big, but act small. It works for retailers like PETCO, Cabela’s, and O’Reilly Automotive, manufacturers like Medline Industries, service companies like Sonic Drive-In, private educational companies like Strayer, industrial giants like Koch Enterprises, and software companies like SAS.

These companies think big ideas about solving customers’ problems, making better products, and creating value. And yet they never stop acting like start-ups—staying humble, treating every employee like the owner, and teaching managers to get their hands dirty.

Get your copy of Think Big, Act Small: How America’s Top Performing Companies Keep the Start-up Spirit Alive by Jason Jennings, today!

The Business Owner’s Guide to Financial Freedom: What Wall Street Isn’t Telling You by Mark J. Kohler & Randall A. Luebke

Tailored for small business owners and entrepreneurs like yourself who are looking for long-term financial planning and wealth management, The Business Owner’s Guide to Financial Freedom reveals the secrets behind successfully investing in your business while bypassing Wall Street-influenced financial planners.

Tailored for small business owners and entrepreneurs like yourself who are looking for long-term financial planning and wealth management, The Business Owner’s Guide to Financial Freedom reveals the secrets behind successfully investing in your business while bypassing Wall Street-influenced financial planners.

Attorney and CPA Mark J. Kohler and expert financial planner Randall A. Luebke deliver a guide catered to your entrepreneurial journey as they teach you how to create assets that provide income so work is no longer a requirement, identify money and tax-saving strategies, and address business succession plans to help you transition into the investment phase of business ownership.

You can’t predict the future, but you can plan for it. So if you’re ready to stop treating your business like your only asset and want to start making it your most valuable legacy, this book is for you!

Get your copy of The Business Owner’s Guide to Financial Freedom: What Wall Street Isn’t Telling You by Mark J. Kohler and Randall A. Luebke, today!

Good to Great: Why Some Companies Make the Leap… And Others Don’t by Jim Collins

Over a span of five years, Jim Collins and his research team analyzed the historical data and management infrastructure of 28 companies in search of why some companies “make the leap” and others don’t.

Over a span of five years, Jim Collins and his research team analyzed the historical data and management infrastructure of 28 companies in search of why some companies “make the leap” and others don’t.

This study showed how great companies grow exponentially over time and how long-term sustainable performance can be duplicated and constructed into the DNA of a company that goes from good to great. But what about companies that are not born with great DNA? How can good companies, mediocre companies, and even bad companies achieve enduring greatness? Are there those that convert long-term mediocrity or worse into long-term superiority? If so, what are the distinguishing characteristics that cause a company to go from good to great?

Find out in our Business Book of the Month selection for September! Get your copy of Good to Great: Why Some Companies Make the Leap… And Others Don’t by Jim Collins!

Your Baby’s Ugly: Maximize Your Business’s Value or You’ll Have Nothing to Sell by Justin Goodbread

Are you creating a business that’s attractive to others—or is it a business only a parent could love? If your business isn’t attractive, you’ll struggle to rise up as a marketplace leader and catch the eyes of financial investors when you need it—or sell your business for profit in the future. You might find yourself heavily involved in every detail, but pouring endless time and energy into your business might not improve its value,—or have an effect on your personal net worth.

Are you creating a business that’s attractive to others—or is it a business only a parent could love? If your business isn’t attractive, you’ll struggle to rise up as a marketplace leader and catch the eyes of financial investors when you need it—or sell your business for profit in the future. You might find yourself heavily involved in every detail, but pouring endless time and energy into your business might not improve its value,—or have an effect on your personal net worth.

In Your Baby’s Ugly, Justin Goodbread offers secrets to nurture your company effectively for better transferability, more longevity, and a bigger appraisal price when you’re ready to sell. With practical advice for small business owners, this is your guide to valuation benchmarks for a profitable, sustainable, and scalable business that could grow your net worth AND decrease your stress.

Order your copy of Your Baby’s Ugly by Justin Goodbread today!

Every Family’s Business by Thomas Deans

Each month, our team selects titles that we feel offer unique and challenging perspectives to help you grow as a leader, and as a business owner. The Financially Simple team knows the value of continuous education in your business and personal life. That’s why we’ve chosen July’s book selection. Every Family’s Business is one of my favorites when it comes to succession and exit planning in a family-owned business. Deans warns against the negative aspects of family units when there is a transfer of a business from one generation to another.

Each month, our team selects titles that we feel offer unique and challenging perspectives to help you grow as a leader, and as a business owner. The Financially Simple team knows the value of continuous education in your business and personal life. That’s why we’ve chosen July’s book selection. Every Family’s Business is one of my favorites when it comes to succession and exit planning in a family-owned business. Deans warns against the negative aspects of family units when there is a transfer of a business from one generation to another.

He offers an easy method for family businesses to begin their own succession plan. This is done through 12 central questions for families to address- he says, silence is the great destroyer of wealth in a family business. After addressing the 12 questions, it will be clear who, when and how the business will be owned and operated in the future — the family succession plan will be born.

Order your copy of Every Family’s Business by Thomas Deans today!

A Random Walk Down Wall Street by Burton G. Malkiel

Each month, our team selects titles that we feel offer unique and challenging perspectives to help you grow as a leader, and as a business owner. The Financially Simple team knows the value of continuous education in your business and personal life. That’s why we’ve chosen June’s book selection.

Each month, our team selects titles that we feel offer unique and challenging perspectives to help you grow as a leader, and as a business owner. The Financially Simple team knows the value of continuous education in your business and personal life. That’s why we’ve chosen June’s book selection.

In today’s daunting investment landscape, the need for Burton G. Malkiel’s reassuring, authoritative, and perennially best-selling guide to investing is stronger than ever. A Random Walk Down Wall Street has long been established as the first book to purchase when starting a portfolio.

This new edition features fresh material on exchange-traded funds and investment opportunities in emerging markets; a brand-new chapter on “smart beta” funds, the newest marketing gimmick of the investment management industry; and a new supplement that tackles the increasingly complex world of derivatives.

Order your copy of A Random Walk Down Wall Street by Burton G. Malkiel today!

The Ultimate Sale: Selling a Business for Maximum Profit by Justin Goodbread

If you own a business and plan to retire one day, the sale of your business MUST be part of your retirement strategy. Are you like most business owners with all of your net worth tied up in your business? If you only have a 20% chance of selling your business, that can be devastating. Even if you are lucky enough to be in the minority who do sell, will you get what you need from the sale to live the lifestyle you want to live?

If you own a business and plan to retire one day, the sale of your business MUST be part of your retirement strategy. Are you like most business owners with all of your net worth tied up in your business? If you only have a 20% chance of selling your business, that can be devastating. Even if you are lucky enough to be in the minority who do sell, will you get what you need from the sale to live the lifestyle you want to live?

The good news is, The Ultimate Sale, written by Certified Exit Planning Advisor, Justin Goodbread, can help you beat those staggering odds and build your business for its final sale. This engaging and thought-provoking title challenges business owners to begin thinking of their business as more than simply a paycheck. Goodbread discusses how to grow your business in ways that not only increase day-to-day efficiencies but also its value as a sellable asset.

Discover proven exit strategies business owners have successfully used to sell their businesses and rise above the statistics. The Ultimate Sale is your guide to navigating business sales, mergers, and buyouts and prepares you and your business for the next chapter in your life.

Get your copy of The Ultimate Sale: A Financially Simple Guide to Selling a Business for Maximum Profit by Justin Goodbread, today!

The Millionaire Next Door: The Surprising Secrets of America’s Wealthy by Thomas J. Stanley & William D. Danko

Why aren’t I as wealthy as I should be?” Many people ask this question of themselves all the time. Often they are hard-working, well-educated middle- to high-income people. Why, then, are so few affluent? For nearly two decades the answer has been found in the bestselling The Millionaire Next Door: The Surprising Secrets of America’s Wealthy, reissued with a new foreword for the twenty-first century. According to the authors, most people have it all wrong about how you become wealthy in America. Wealth in America is more often the result of hard work, diligent savings, and living below your means than it is about inheritance, advanced degrees, and even intelligence.

Why aren’t I as wealthy as I should be?” Many people ask this question of themselves all the time. Often they are hard-working, well-educated middle- to high-income people. Why, then, are so few affluent? For nearly two decades the answer has been found in the bestselling The Millionaire Next Door: The Surprising Secrets of America’s Wealthy, reissued with a new foreword for the twenty-first century. According to the authors, most people have it all wrong about how you become wealthy in America. Wealth in America is more often the result of hard work, diligent savings, and living below your means than it is about inheritance, advanced degrees, and even intelligence.

The Millionaire Next Door identifies seven common traits that show up again and again among those who have accumulated wealth. You will learn, for example, that millionaires bargain shop for used cars, pay a tiny fraction of their wealth in income tax, raise children who are often unaware of their family’s wealth until they are adults, and, above all, reject the big-spending lifestyles most of us associate with rich people. In fact, you will learn that the flashy millionaires glamorized in the media represent only a tiny minority of America’s rich. Most of the truly wealthy in this country don’t live in Beverly Hills or on Park Avenue-they live next door.

Get your copy of The Millionaire Next Door: The Surprising Secrets of America’s Wealthy by Thomas J. Stanley & William D. Danko today!

The E-Myth: Why Most Small Businesses Don’t Work and What to Do About It by Michael Gerber

The E-Myth dispels the myths about starting your own business. Michael E. Gerber points out how common assumptions, expectations, and even technical expertise can get in the way of running a successful business. The E-Myth Revisited walks you through each step in the life of a business. Teaching you how to apply franchising lessons to any business, Gerber draws the vital, often overlooked distinction between working on your business and working in your business.

The E-Myth dispels the myths about starting your own business. Michael E. Gerber points out how common assumptions, expectations, and even technical expertise can get in the way of running a successful business. The E-Myth Revisited walks you through each step in the life of a business. Teaching you how to apply franchising lessons to any business, Gerber draws the vital, often overlooked distinction between working on your business and working in your business.

Building a cult-like following among entrepreneurs since it was published, Gerber strives to “Bring the dream back to business.” Gerber suggests that those who succeed in business aren’t the ones who think they know everything. Instead, it’s those who are driven to know more that often find the success they desire. With an eye on scalability and the principles used in franchising, you could transform your business to more closely represent what you’ve always envisioned.

Get your copy of The E-Myth: Why Most Businesses Don’t Work and What to Do About It by Michael Gerber, today!

The Dream Manager by Matthew Kelly

The Dream Manager by Matthew Kelly

Beginning with his important thought that a company can only become the best version of itself to the extent that its employees are becoming better versions of themselves, Matthew Kelly explores the connection between the dreams we are chasing personally and the way we all engage at work. Tackling head-on the growing problem of employee disengagement, Kelly explores the dynamic collaboration that is unleashed when people work together to achieve company objectives and personal dreams.

The power of The Dream Manager is that simply becoming aware of the concept will change the way you manage and relate to people instantly and forever. What’s your dream?

Get your copy of The Dream Manager by Matthew Kelly, today!

Scaling Up: How a Few Companies Make It… and Why the Rest Don’t by Verne Harnish

It’s been over a decade since Verne Harnish’s best-selling book Mastering the Rockefeller Habits was first released. Scaling Up (Rockefeller Habits 2.0) is the first major revision of this business classic which details practical tools and techniques for building an industry-dominating business. This book is written so everyone ― from frontline employees to senior executives ― can get aligned in contributing to the growth of a firm. Scaling Up focuses on the four major decision areas every company must get right: People, Strategy, Execution, and Cash.

It’s been over a decade since Verne Harnish’s best-selling book Mastering the Rockefeller Habits was first released. Scaling Up (Rockefeller Habits 2.0) is the first major revision of this business classic which details practical tools and techniques for building an industry-dominating business. This book is written so everyone ― from frontline employees to senior executives ― can get aligned in contributing to the growth of a firm. Scaling Up focuses on the four major decision areas every company must get right: People, Strategy, Execution, and Cash.

The book includes a series of new one-page tools including the updated One-Page Strategic Plan and the Rockefeller Habits ChecklistTM, which more than 40,000 firms around the globe have used to scale their companies successfully ― many to $10 million, $100 million, and $1 billion and beyond – while enjoying the climb!

Get your copy of Scaling Up: How a Few Companies Make It… and Why the Rest Don’t by Verne Harnish, now!

Extreme Ownership: How U.S. Navy Seals Lead and Win by Jocko Willink and Leif Babin

Since its release in October 2015, Extreme Ownership has revolutionized leadership development and set a new standard for literature on the subject. Required reading for many of the most successful organizations, it has become an integral part of the official leadership training programs for scores of business teams, military units, and first responders.

Since its release in October 2015, Extreme Ownership has revolutionized leadership development and set a new standard for literature on the subject. Required reading for many of the most successful organizations, it has become an integral part of the official leadership training programs for scores of business teams, military units, and first responders.

Detailing the resilient mindset and total focus principles that enable SEAL units to accomplish the most difficult combat missions, Extreme Ownership demonstrates how to apply them to any team or organization, in any leadership environment. A compelling narrative with powerful instruction and direct application, Extreme Ownership challenges leaders everywhere to fulfill their ultimate purpose: lead and win.

Get your copy of Extreme Ownership: How U.S. Navy Seals Lead and Win by Jocko Willink and Leif Babin, today!

The Truth About Money by Ric Edelman

Ric Edelman, America’s most successful financial advisor, has revised and updated his classic personal finance bestseller to reflect the new global economic outlook. In his 4th edition of The Truth About Money, Edelman tells you everything you need to know about money—an essential, yet delightfully breezy and accessible, must-read manual for anyone who may have previously sought the financial wisdom of Suze Orman and Jean Chatzky. The Truth About Money is an indispensable guide to money matters from the man whom Barrons named the #1 independent financial advisor in the country.

Ric Edelman, America’s most successful financial advisor, has revised and updated his classic personal finance bestseller to reflect the new global economic outlook. In his 4th edition of The Truth About Money, Edelman tells you everything you need to know about money—an essential, yet delightfully breezy and accessible, must-read manual for anyone who may have previously sought the financial wisdom of Suze Orman and Jean Chatzky. The Truth About Money is an indispensable guide to money matters from the man whom Barrons named the #1 independent financial advisor in the country.

Get your copy of The Truth About Money now!

The Energy Bus: 10 Rules to Fuel Your Life, Work, and Team with Positive Energy by Jon Gordon

We all need a boost of positivity from time to time. How you approach each day, task, or challenge in your business — and in life — has a serious effect on you and your team. Do you approach things with an abundance mindset or with stress, fear, and scarcity? Believe it or not, attitude equals success. That’s why we’ve chosen this title for September’s Book of the Month!

We all need a boost of positivity from time to time. How you approach each day, task, or challenge in your business — and in life — has a serious effect on you and your team. Do you approach things with an abundance mindset or with stress, fear, and scarcity? Believe it or not, attitude equals success. That’s why we’ve chosen this title for September’s Book of the Month!

The Energy Bus, an international best seller by Jon Gordon, takes readers on an enlightening and inspiring ride that reveals 10 secrets for approaching life and work with the kind of positive, forward-thinking that leads to true accomplishment at work and at home. Jon infuses this engaging story with keen insights as he provides a powerful roadmap to overcome adversity and bring out the best in yourself and your team. When you get on The Energy Bus you’ll enjoy the ride of your life.

Get your copy of The Energy Bus: 10 Rules to Fuel Your Life, Work, and Team with Positive Energy now!

Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones by James Clear

No matter your goals, Atomic Habits offers a proven framework for improving–every day. James Clear, one of the world’s leading experts on habit formation, reveals practical strategies that will teach you exactly how to form good habits, break bad ones, and master the tiny behaviors that lead to remarkable results. If you’re having trouble changing your habits, the problem isn’t you. The problem is your system. Bad habits repeat themselves again and again not because you don’t want to change, but because you have the wrong system for change. You do not rise to the level of your goals. You fall to the level of your systems. Here, you’ll get a proven system that can take you to new heights.

No matter your goals, Atomic Habits offers a proven framework for improving–every day. James Clear, one of the world’s leading experts on habit formation, reveals practical strategies that will teach you exactly how to form good habits, break bad ones, and master the tiny behaviors that lead to remarkable results. If you’re having trouble changing your habits, the problem isn’t you. The problem is your system. Bad habits repeat themselves again and again not because you don’t want to change, but because you have the wrong system for change. You do not rise to the level of your goals. You fall to the level of your systems. Here, you’ll get a proven system that can take you to new heights.

Clear is known for his ability to distill complex topics into simple behaviors that can be easily applied to daily life and work. Here, he draws on the most proven ideas from biology, psychology, and neuroscience to create an easy-to-understand guide for making good habits inevitable and bad habits impossible. Along the way, readers will be inspired and entertained with true stories from Olympic gold medalists, award-winning artists, business leaders, life-saving physicians, and star comedians who have used the science of small habits to master their craft and vault to the top of their field.

Start building good habits with this small step. Get your copy of Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones today!

The Great Game of Business: The Only Sensible Way to Run a Company by Jack Stack

The Great Game of Business started a business revolution by introducing the world to open-book management, a new way of running a business that created unprecedented profit and employee engagement.

The revised and updated edition of The Great Game of Business lays out an entirely different way of running a company. It wasn’t dreamed up in an executive think tank or an Ivy League business school or around the conference table by big-time consultants. It was forged on the factory floors of the Heartland by ordinary folks hoping to figure out how to save their jobs when their parent company, International Harvester, went down the tubes.

What these workers created was a revolutionary approach to management that has proven itself in every industry around the world for the past thirty years—an approach that is perhaps the last, best hope for reviving the American Dream.

Regardless of which stage of business you’re in, it’s never too late to change the game. Get your copy of The Great Game of Business: The Only Sensible Way to Run a Company now!

Take the Stairs: 7 Steps to Achieving True Success by Rory Vaden

Do you ride the escalator – or take the stairs?

No matter how you define success, it always requires one thing: self-discipline. But as a popular speaker and strategist Rory Vaden explains, we live in an “escalator world” — one that’s filled with shortcuts, quick fixes, and distractions that make it all too easy to slide into procrastination, compromise, and mediocrity. What seems like an easier path is really much harder in the end, and, most important, it won’t take you where you want to go.

How do successful people stay focused and achieve results? This lively and insightful guide presents a simple program for taking the stairs – that is, for overcoming the temptations of quick fixes and procrastination, conquering creative avoidance, and transcending personal setbacks in order to tackle the work that leads to real success. Whatever your goals are, Rory Vaden’s approach will help you get there — one stair at a time. Get your copy of Take the Stairs; 7 Steps to Achieving True Success, today!

The Anatomy of Peace by The Arbinger Institute

What if conflicts at home, at work, and in the world stem from the same root cause? What if we systematically misunderstand that cause? And what if, as a result, we unwittingly perpetuate the very problems we think we are trying to solve?

The Anatomy of Peace uses a fictional story of an Arab and a Jew—both of whom lost their fathers at the hands of the other’s cousins—to powerfully show readers the way to transform conflict. We learn how they come together, how they help parents and children come together, and how we too can find our way out of the personal, professional, and social conflicts that weigh us down. Get your copy of The Anatomy of Peace, today!

The Five Dysfunctions of a Team: A Leadership Fable by Patrick Lencioni

In The Five Dysfunctions of a Team Patrick Lencioni once again offers a leadership fable that is as enthralling and instructive as his first two best-selling books, The Five Temptations of a CEO and The Four Obsessions of an Extraordinary Executive. This time, he turns his keen intellect and storytelling power to the fascinating, complex world of teams.

Order your copy of The Five Dysfunctions of a Team: A Leadership Fable, today!

Predictable Success by Les McKeown

No matter what kind of organization you work for, whether it’s your own small business or a global Fortune 100 company, your number-one goal is success. Predictable Success takes you step-by-step through a startlingly simple, intuitive, and universal process that shows you how to bring sustained, lasting, predictable success to your organization.

No matter what kind of organization you work for, whether it’s your own small business or a global Fortune 100 company, your number-one goal is success. Predictable Success takes you step-by-step through a startlingly simple, intuitive, and universal process that shows you how to bring sustained, lasting, predictable success to your organization.

Find out where your organization is today and take the uncertainty out of tomorrow as you make the journey towards Predictable Success.

The Richest Man in Babylon by George Samuel Clause

Written in 1926, The Richest Man in Babylon may often get overlooked as a top financial read with some of today’s heavy hitters. However, it’s a book I recommend hands down to everyone who is seeking to gain financial wisdom. It is plain and simple advice set up as common sense stories that will not only enlighten you but keep you entertained as well. It’s just a really good book for those who don’t like to read the typical self-help books that tell you to do A, B, and C to get E, F, and G. Without a doubt, it’s a down-to-earth book chocked full of knowledge that if followed will help you get on the financial track you’ve been looking for.

Written in 1926, The Richest Man in Babylon may often get overlooked as a top financial read with some of today’s heavy hitters. However, it’s a book I recommend hands down to everyone who is seeking to gain financial wisdom. It is plain and simple advice set up as common sense stories that will not only enlighten you but keep you entertained as well. It’s just a really good book for those who don’t like to read the typical self-help books that tell you to do A, B, and C to get E, F, and G. Without a doubt, it’s a down-to-earth book chocked full of knowledge that if followed will help you get on the financial track you’ve been looking for.

Think and Grow Rich by Napoleon Hill/Ben Holder-Crowther

This is another old book, published in 1937, that is actually considered the original motivational book. It’s one of the founding books that every financier will ever read. The premise of Think and Grow Rich is, what makes a winner? Basically, exploring how to succeed at whatever you do in life. Hill wrote the book during the Great Depression in an attempt to propel his readers to change the course of their future. He basically says—you can do this if you stop and think.

This is another old book, published in 1937, that is actually considered the original motivational book. It’s one of the founding books that every financier will ever read. The premise of Think and Grow Rich is, what makes a winner? Basically, exploring how to succeed at whatever you do in life. Hill wrote the book during the Great Depression in an attempt to propel his readers to change the course of their future. He basically says—you can do this if you stop and think.

Rich Dad Poor Dad by Robert Kiyosaki

Considered the #1 personal finance book of all time, Kiyosaki tells his readers of two dads…supposedly his real father and the father of his best friend. The two men have completely different attitudes when comes to money—one understands how money works and the other doesn’t. In Rich Dad Poor Dad, Kiyosaki contends that it’s a mindset that will help you develop the habits you need in order to build wealth, claiming it’s not where you were born…it’s not the circumstances you face in life…it’s basically all about your habits.

Considered the #1 personal finance book of all time, Kiyosaki tells his readers of two dads…supposedly his real father and the father of his best friend. The two men have completely different attitudes when comes to money—one understands how money works and the other doesn’t. In Rich Dad Poor Dad, Kiyosaki contends that it’s a mindset that will help you develop the habits you need in order to build wealth, claiming it’s not where you were born…it’s not the circumstances you face in life…it’s basically all about your habits.

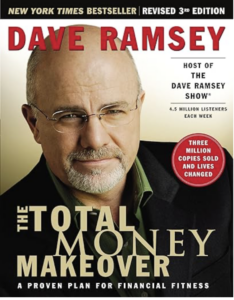

Total Money Makeover by Dave Ramsey

The success stories speak for themselves in The Total Money Makeover by Dave Ramsey. Instead of promising the normal dose of quick fixes, Ramsey offers a bold, no-nonsense approach to money matters, providing not only the how-to but also a grounded and uplifting hope for getting out of debt and achieving total financial health.

The success stories speak for themselves in The Total Money Makeover by Dave Ramsey. Instead of promising the normal dose of quick fixes, Ramsey offers a bold, no-nonsense approach to money matters, providing not only the how-to but also a grounded and uplifting hope for getting out of debt and achieving total financial health.

Ramsey debunks the many myths of money (exposing the dangers of cash advance, rent-to-own, debt consolidation) and attacks the illusions and downright deceptions of the American dream, which encourages nothing but overspending and massive amounts of debt. “Don’t even consider keeping up with the Joneses,” Ramsey declares in his typically candid style. “They’re broke!”

These books have been read by myself, my family, and my staff many times. I do recommend heading over to your local library and checking them out. If you prefer to own them (as I do) we have made it easy for you to order. Simply click on the book’s image and you will be whisked off to Amazon.com for great deals on them.

Enjoy educating yourself and need book recommendations?

If you sign up for the Financially Simple newsletter we will keep you abreast of not just what we are reading but also tons of ways to make your business education… financially simple!

Here at Financially Simple™, we want to help you make informed and confident financial decisions for your small business. In doing so, we might recommend products and services that offer us compensation when you use them. This compensation is used to help offset the cost of creating the content we give to you for free. However, we will never suggest products/services solely for the compensation received. Our goal is to make understanding money as a business owner, a family, and anyone visiting this website—financially simple.