Inflation is Coming… What Does It Mean for Small Business?

June 18, 2021

How to Prepare for Your 6-Month Strategic Planning Meeting

June 28, 2021Four Steps to Creating a Small Business Budget

I received a listener question, recently, that made me take pause. I was thinking back on the show’s history, and I don’t believe I’ve ever addressed this topic before now. The question was, “Justin, how do we create a small business budget?” Although budgeting is a relatively simple concept, knowing how to create a well-functioning small business budget can be a little confusing if you don’t have experience doing so. I’m using today’s entry to show you four quick and easy steps to create a budget for your business.

Follow Along With The Financially Simple Podcast!

TIME INDEX:

- 00:43 – Four Easy Steps to Creating a Small Business Budget

- 03:15 – Some Facts

- 06:08 – Have Separate Accounting Software

- 06:57 – Profit and Loss

- 09:12 – Adjust the Historical to Reflect the Future

- 11:32 – Program the Budgeting Tool

- 12:09 – Summary

- 13:53 – Wrap Up

Small Business Budgets Don’t Need to Be Complicated

I recently acquired some new property and wanted to build a gate that opened up to the new property from my farm. To do this, I needed to drive some huge posts into the ground. One of my neighbors was helping me do this, and he said something to me that I didn’t understand. It wasn’t until he actually showed me that the lightbulb came on. You see, in his years of experience, he had learned a technique that made driving these posts so much easier. Once he showed me, we were able to complete the job with ease.

This was a good reminder that I often take for granted how my experience in the financial industry can cause me to view certain tasks and ideas as assumptive in nature. I might gloss over the subject because I’m assuming that everyone understands it. However, this isn’t always the case. How can we understand something if it’s never been explained?

This past weekend, at church, I was speaking with another business owner who asked what the next podcast would be about. When I told him, he replied, “Justin, that’s fantastic. I don’t have a budget for my business.” The crazy part of this is that this particular gentleman is operating a business that pulls in eight figures. Candidly, I didn’t operate my own businesses with a budget when I started either. However, having a small business budget is an important part of business ownership, and it doesn’t need to be complicated. Like my neighbor helping me find a simpler way to drive posts, I can show you a few techniques to simplify creating your business’s budget.

Why Budgeting Is Important

Before I go into how to create a small business budget, I want to take a moment to explain why it’s so important. According to a U.S. Bank study, 82% of businesses fail due to cash flow problems. Similarly, Investopedia lists the four most common reasons small businesses fail: a lack of sufficient capital, poor management, inadequate business planning, and overblowing their marketing budgets. Now, if you really think about it, all four of those are directly related to budgeting.

Another study, conducted by Clutch, surveyed 335 business owners. They found that the smallest businesses are the least likely to have a budget. In my opinion, the smaller your business is, the more valuable a budget can be to your success. However, they also found that businesses that made budgets usually stick to them.

However, they also found that businesses that made budgets usually stick to them.

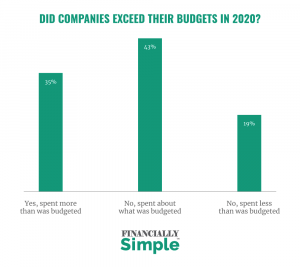

Now, last year was a crazy year. According to Small Biz Genius, 50% of small businesses did not create an official, formally documented budget in 2020. But we were actually able to coach business owners to improve their businesses in the midst of the chaos because of their budgets. The same survey concluded that 19% of companies with ten or fewer employees didn’t make any budget in 2020; of those companies that did have a budget, only about a third spent more than their budget. This supports the findings from the Clutch survey. So, how can you create a small business budget that works?

With these four simple steps, you can successfully create a small business budget that works for you.

Four Steps to Creating a Small Business Budget

1. Keep separate accounting software for your business.

2. Generate a profit and loss or income statement.

3. Review past numbers and adjust them for your future projections.

4. Use the information from your P&L and your projections to program the budgeting tool in your accounting software.

Have Separate Accounting Software

I know many people who rely entirely on bank statements or their checkbook ledger to track their finances. Although this may work in your personal finances—though I don’t recommend it—you need something more than this for your small business budget. There are a variety of accounting software out there that can be used for this. I use QuickBooks by Intuit, but others work just as well. The important thing is that you have separate accounting software. You don’t want your accounting numbers coming from your business’s bank account because you won’t have the full picture.

Keep a Profit and Loss Statement

Generate a profit and loss statement in an Excel format. This can be done directly through your accounting software. Now, depending on your software, it might be called a P&L, a profit and loss statement, an income statement, or even a profit and loss income statement. These are all just different names for the same thing. A profit and loss statement provides you with a quick reference to all money that comes in and goes out from your business.

Generating the profit and loss statement in an Excel format is vital in creating a small business budget. Why? Because that’s what you’re going to use to create your formal written budget. When you download your profit and loss statement, you’re going to see all of your classifications of revenue. Likewise, you’ll see gross profits, gross margins, net operating income, etc. So, in one easy reference, you’re going to be able to identify all of your expenses from advertising to the cost of goods sold (if you’re in a service industry). This is especially useful if you’ve been in business for a while. You can download three to four years’ worth of income statements to identify trends. You can actually plot your different line items using the Excel graphing functions and see how your expenses have changed from year to year. This gives you the ability to take the third step in creating your small business budget.

Adjust the Historical to Reflect the Future

This is actually much simpler than it sounds. Let’s say your advertising budget for last year was 4% of your business’s gross revenue. But, to get your business where you want it to be, you need to increase that number to 6%. The problem is that you need to decrease your budget for another expenditure by an equal amount by increasing your advertising budget. How do you do it? Well, perhaps you were overpaying on some of your technologies. In this scenario, you would renegotiate some of your technology contracts to align with where they should be.

Now, I know some of you are reading this and thinking, “Justin, I don’t have a clue how to do that.” That’s okay. If this is you, reach out to us. We literally do this every single day for our clients. We help with every aspect of our client’s businesses. But to effectively adjust the historical to reflect the future, you must know where you’re going. You need to know your mission and your vision and align your goals with them. When you know where you’re going, you can build your incoming dollars to match what your future is going to be. Your future projections should be inputted into “Column C” of your profit and loss statement. Once you’ve completed this process with each line item and revenue classification, you’re ready to move onto the final step.

Program the Budgeting Tool

Most accounting software has the ability to track your budget. At this point, you’ve generated a “column C” in your Excel formatted profit and loss statement. Now you program your numbers into the budgeting tool included in your accounting software, and it automatically tracks it for you. Friends, this is super easy. However, if you think you don’t care how easy it is and you just don’t want to do it, that’s fine. Let us help you.

Wrapping Up…

Creating a small business budget is as simple as following these four easy steps. Some business owners haven’t created a budget because they weren’t sure where to begin. Others, like myself, were just too lazy to do so. But having a formal budget in place is such a powerful tool for your business and enables you to determine how your company’s revenues work for you.

As always, life is hard, but it’s good. Creating a small business budget can be frustrating, but it doesn’t have to be. With these four easy steps, you can make creating your budget, at least, financially simple.

Does your business have a formal budget in place? Do you still have questions about creating an accurate budget for your business? Reach out to us. The team at Financially Simple is always here to help make your business as successful as possible.