Determining How to Pay Yourself as a Small Business Owner

April 29, 2019

Hiring A Spouse as An Employee – A Smart Option with Many Benefits

May 3, 2019“How Much Should I Pay Myself?” The Business Owner’s Guide

In this post, I’m going to tackle one of the most difficult areas of financial planning. This single area – this one single thing – will make or break your financial future. Today’s topic is how much should you pay yourself as a small business owner.

Podcast Time Index for “How Do I Determine How Much to Pay Myself?”

- 01:10 – How Do I Determine How Much to Pay Myself?

- 02:03 – Personal Budget

- 04:37 – What is a Dream Budget?

- 07:34 – Needs

- 13:42 – Fine Tuning

- 15:16 – A Tricky Balancing Act

- 16:43 – Summary

Two Simple Words Determine How Much to Pay Yourself

As you know, I spent my last blog series dealing with growing your business and adding maximum value to it. Yet, many times, business owners don’t think about how much to pay themselves. Inevitably, you end up going to work, busting it, producing revenue, paying bills through the company, and taking whatever’s left at the end of the day, week, month, or year. You simply take the spoils.

But friends, there’s a better way. You can actually control your personal financial life as a business owner. You see the question of how much you should pay yourself boils down to two simple words – personal budget. Your personal budget dictates how much money you should pay yourself from your business. Budgets don’t have to be something negative. In reality, if you can dictate where all of your different monies flow, then you can gain financial freedom. So, let’s walk through the process of building your personal budget.

The Dream Budget

To determine how much you should pay yourself from your business, you need to build a dream budget for your personal life. Maybe you use budgeting software from a company like Mint or QuickBooks. However you do it, you need to identify how much money you are spending each month or how much money you should be spending each month. An ideal budget exists, but what is it? What is the dream budget for your personal life? Well, let’s break it down into percentages to help you identify your dream budget.

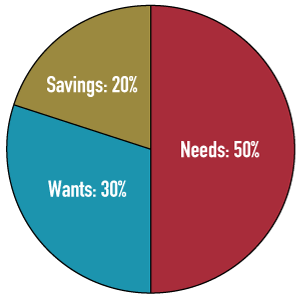

Your Needs

First of all, 50% of your net income (the amount of money you deposit into your personal account) should go towards your needs. Whether you call these things “fixed expenses” or “non-discretionary expenses”, your needs are things like housing, food, clothes, transportation, medical, and minimum debt payments. Therefore, if you’re making $100,000, that means that $50,000 should go to your needs.

Your Wants

Next, 30% of your take-home pay should go to your wants. These are things like entertainment, vacations, restaurants, events, and “toys.” Again, if you’re making $100,000, then you can put $30,000 toward your wants.

Yet, here’s where it gets tricky. You need to make sure that you don’t place your wants in the needs category. Your needs are the things you have to pay come hell or high water. If the economy crashes, you still need to have a place to live. You still need clothes and food. However, you may start buying cheaper food and less expensive clothing.

However, if the economy crashes, you probably aren’t going to take family vacations. You may not eat out at fancy restaurants anymore. No, you’ll go buy some rice and beans and boil them in a crockpot and thank Jesus for the food. That’s what you’re going to do. That’s a need. Your wants are in excess of that. It’s discretionary money, variable money.

Your Savings

If you’re keeping track, 20% of your income is left over after paying for your wants and needs. In the ideal budget, 20% should go towards savings and investments. Build up an emergency fund. Fund your retirement plans. Save for your summer vacation. Strategically save for long-term and short-term goals.

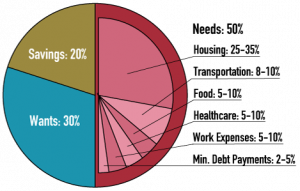

Allocating Your Needs

Breaking your income into 3 main categories sounds easy, right? But how do you break down the items within your needs? How do you know how much to spend on housing versus food and medical expenses? Well, let’s dig into that.

Housing

Of the money you’re spending on your needs, only 25-35% should go to housing. Therefore, if you make $100,000, then you should be spending $25,000 – $30,000 a year on housing, or $2,083 – $2,917 each month. Now, note that I didn’t say your “house payment.” I said “housing.” This includes home insurance, taxes, utilities, maintenance, and repairs. However, that’s much easier said than done. I realize that owning or renting a house can be expensive. Nonetheless, I want you to know what the ideal budget is.

Transportation

Oftentimes, your housing determines your mode of transportation. Maybe you live across the street from your business, or perhaps you must take a bus or a train to your company each day. Some of you have to drive 20 – 60 miles to work each day. No matter what, you have to deal with transportation. In the ideal budget, 7-10% should go to transportation. Again, this is not just a car payment. It’s insurance, gas, maintenance, taxes, and registration.

Groceries

Next, you have your grocery needs – your food, toothpaste, shampoo, dog food, etc. This is the money you spend at Walmart, Target, or your local grocery store. You can lump a lot of things into the grocery part, so I don’t want to get too technical about what goes in this section. But, I do want to tell you that 5-10% of your needs allocation should go to groceries. That’s not much, friends. That’s going to be $5,000 – $10,000 annually if you make $100,000 in take-home pay.

Healthcare

Another 5-10% of your budget should go to health care. This could be insurance premiums, doctor’s visits, dental visits, glasses, hearing aids, and more. I know that some people will cut this from their budget when they feel that things have gotten a little too tight. I would caution you not to do this. You never know when sickness or injuries may occur and all it takes is one extended hospital stay to bankrupt many people.

Work-Related Expenses

After health expenses, 5-10% of your budget should go to work-related expenses. In reality, this could include transportation or parking. It could also include education and childcare expenses.

Minimum Debt Payments

Finally, 2-5% of your take-home pay should go to pay your minimum debt payments. These are not your car payments or your house payments because those are covered under housing and transportation. Instead, these are your other payments – your credit card payments or other loans you might have. Additionally, if you’re able to pay more than the minimum, it could be beneficial to do so. You could pay off your debt faster and save money in interest payments. However, there are strategic uses for debt, as well. Consult your financial advisor before making any major decisions regarding your debt.

How to Live Within the Ideal Budget

At this point, you’re saying, “Justin, everything you just described eats up 70-90% of my after-tax pay, not 50%!” Okay, so you’re not living within the ideal budget. Technically, you should only be spending 50% of your take-home pay on your needs, but you may be spending 70-90% of it on your needs. So what do you do?

- The first thing you’re going to do is “steal” your money from your wants bucket.

Remember your wants? Those were the extra expenses you didn’t necessarily need. You’re going to reduce your wants to accommodate your needs. Eat out less. Reduce your entertainment. Delay your vacation. - The second thing you can do is you can increase your income.

Maybe it’s time to increase the money you’re taking home from the company. Perhaps, you need to increase your business or start a side hustle. - If neither of those things is possible, it’s time to do a massive overhaul of your financial life.

It may be time to sell your house or your cars. Perhaps you need to sell more “stuff.” Whatever you do, you have to bring your budget in line. Until you can get your needs down to 50% of your income, you may have to take some measures to reduce expenses or increase income.

How Your Ideal Budget Determines Your Take-Home Pay

You know how to pay yourself as a small business owner. But, once you’ve built your ideal budget, you can determine how much to pay yourself. Keep your expenses to 50% needs, 30% wants, and 20% savings. Now that you know what your current expenses are, how much do you need to pay yourself from your small business? Do you need to make adjustments to your personal expenditures, or do you need to increase your business’ revenue to increase your income? Can you live within your ideal budget with the money you’re taking home?

Essentially, the money you pay yourself should EQUAL to your dream budget lifestyle. If you take home too little, you risk personal bankruptcy or financial troubles. If you take home too much, you risk paying more in taxes than you want to pay. Therefore, talk to your financial advisor and to your CPA. Lay out your dream budget and make sure it fits within your plans and your tax plans.

Be sure to join me in the next article where I’ll talk about one of our top questions: can I hire my spouse to get tax benefits?

Look, determining these kinds of pay strategies within your business can be tricky. Luckily you have access to experts. We would happy to discuss your specific situation and work with you to build financial plans that help both your personal financial goals and business payroll needs.

Here at Financially Simple™ we want to help you make informed financial decisions for your small business with confidence. In doing so, we might recommend products and services that offer us compensation when you use them. This compensation is used to help offset the cost of creating the content we give to you for free. We will, however, never suggest products/services solely for the compensation received. As stated before, our goal is to make understanding money for you the business owner, your family, and anyone visiting this website—financially simple.