Effective End-of-Year Marketing: A Financially Simple Guide

December 1, 2021

How to Create Change in Business

December 23, 2021Understanding Retirement Risk and the Myths Business Owners Believe

At some point, each one of us will retire. This is true of every trade and profession, employee and business owner alike. However, as business owners, there are some risks that you must address. But to do so, you must also be able to differentiate the truth from myth. I recently took a hunting trip to Idaho with some fellow business owners and kept hearing some of the myths around retirement creep into our conversations. That’s why I decided to speak with my dear friend and colleague, Mr. Jeff Jeter CFP®, ChFP®, CEPA® about the risks and myths of retirement. Join me as I share the nuggets of wisdom gleaned from our conversation and uncover the truth about retirement risk and the myths business owners believe.

Follow Along With The Financially Simple Podcast!

TIME INDEX:

- 00:42 – Retirement Myths Business Owners Believe, with Jeff Jeter

- 02:32 – Your Baby is Ugly

- 03:59 – Timing, Timing, Timing

- 05:51 – What’s Your Number

- 07:04 – Intent and Due Diligence

- 08:47 – Timeframes

- 10:57 – Diversification

- 13:00 – The Tax Triangle

- 14:28 – Take-aways

- 15:40 – Money, Money, Money

- 17:37 – Summary

Common Retirement Myths Business Owners Tell Themselves

First, and perhaps the biggest lie business owners believe, is that their business is worth more than it really is. Folks, I literally wrote the book on this. Your Baby’s Ugly is all about proximity blindness and how it can cripple your ability to leverage your greatest asset for retirement. I hear from business owners all the time, who believe their business is worth more than it is. This is usually based on the annual revenues of the business. Although revenues are a part of the business valuation, there are several factors that can cause the value to be more or less than you might anticipate. For example, if your business sees $1MM in annual revenue but all of the business processes must run through you, your business isn’t worth much, if anything, to prospective buyers. Ultimately, your business is worth whatever someone is willing to pay for it. It’s up to you to do the things that will increase the multiplier.

The next myth is made far worse by the fact that so many believe their businesses are worth more than they truly are. Many times, we see business-owning clients who don’t have assets outside of their business. Rather than diversifying, they believe they can just slap a For Sale sign on their business when they’re ready to retire and then ride off into the sunset, living on the proceeds from the sale. Unfortunately, the numbers don’t support that belief. According to the Exit Planning Institute (EPI), only around 20%-30% of businesses are able to be sold. Even fewer are able to do so without concessions by the owner.

Retirement Risk

One of the biggest problems with believing these myths is the level of risk you open yourself up to. If you believe that you’re going to just put your business up for sale and someone’s going to immediately walk up and hand you a check for what you believe the business is worth, then your exit plan needs a major overhaul. Without taking the necessary steps today, you will never hit your retirement goals. What will you do if you’re suddenly forced to sell your business because of disability or illness? How will market disruption impact the saleable value of your business? These are things that must be considered and built into your exit plan.

The truth is, even if you get a letter of intent, so much can change between that moment and closing. During the due diligence period, the price, terms, conditions, and ongoing income can all change. Through all of this, your accounting team must also be at work to ensure that you’re paying the taxes you’ll owe from the sale without overpaying. So, when should you begin making preparations for a sale? According to Jeff, you should begin the process, at a minimum, 12 to 18 months before placing your business on the market. Even that is an aggressive schedule. However, giving your CEPA® team at least that much time will help to mitigate some of the types of retirement risk you could face.

Yet, to combat retirement risk, you must diversify beyond your business. You need to realize that your business may not sell for as much as you believe it will, or at all. So, how do you diversify away from your business while still working to grow the value?

Using the Tax Triangle to Diversify

At my firm, we like to tell clients that we have a goal of doubling their net worth every three to five years. Now, this isn’t always possible, as each client is unique, but we like to make that a goal. The way we do this is by working to increase the intrinsic value of their business. However, when it’s time to retire, you need to have a more diverse set of assets. This is because when you’ve retired, you will no longer have that business to provide you with income.

So, we want to begin spreading some of that wealth to other income-producing assets. But we also want to do so in a tax-sensitive way because, believe it or not, taxes are a big retirement risk. Therefore, we like to have clients put money into long-term investments that make up what we like to call the tax triangle. Basically, the tax triangle uses tax-deferred (things like your business, 401Ks, etc.), tax-free (Roth IRAs and other pre-taxed items), and taxable (assets with no tax restrictions) assets to grow wealth while helping to mitigate your tax liabilities for the future and the present day.

This method protects your wealth from being completely eaten up by Uncle Sam. It does this by alleviating some of your present tax burdens, utilizing assets that allow you to grow wealth and pay the tax at a later date. Likewise, it allows you to pay the taxes for other assets at today’s tax rate, growing money without having to worry about what the tax rate will be when you’re ready to withdraw your money. But what can you do to mitigate retirement risks when you’re in retirement?

Remain Flexible in Retirement

As you’re planning for retirement, you must plan for the risks that come with it. However, retirement isn’t a hedge fund. Because you’re retired, your liabilities should have decreased. Therefore, you have some flexibility. If inflation hits, as it currently is, you may need to invest a small amount to offset the impact it has on your retirement accounts. If the markets take a downturn, you could make a small adjustment to your spending habits to weather the storm until the market restabilizes.

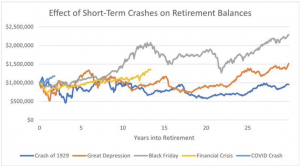

I understand the concerns and the fears, but the risk in retirement is different than the risk you face while planning for retirement. In fact, there have been five major stock market crashes of 30% or more since 1928. This graph from ThinkAdvisor shows what would happen to a couple retiring six months before each crash and following the “4% Rule” (the author of the 4% rule has recently updated it to the 4.5% rule to adjust for inflation). As you can see, all outcomes made their way back above the principle, except the Covid crash which is still in recovery.

I understand the concerns and the fears, but the risk in retirement is different than the risk you face while planning for retirement. In fact, there have been five major stock market crashes of 30% or more since 1928. This graph from ThinkAdvisor shows what would happen to a couple retiring six months before each crash and following the “4% Rule” (the author of the 4% rule has recently updated it to the 4.5% rule to adjust for inflation). As you can see, all outcomes made their way back above the principle, except the Covid crash which is still in recovery.

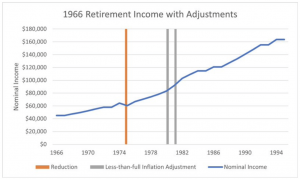

Similarly, the chart below shows the portfolio of a couple who retired in 1966. They retired just before a prolonged period of high inflation and low real returns. Additionally, they had a portfolio valued at $1MM in today’s dollars. The couple started off making $45,000 per year in portfolio withdrawals. Similarly, they planned to adjust their withdrawals for inflation over time. With just a single reduction in nominal income (in 1975) along with two less-than-full inflation adjustments (in 1980 and 1981), they would have retained over $800,000 in portfolio balance after 30 years. So, small adjustments can make a big difference when you’re dealing with risk in retirement.

Wrapping Up…

Friends, as you can see, there are some myths that business owners must stop believing. Likewise, retirement risk is something you must plan for. However, the risk in retirement isn’t often as great as you may fear. Regardless of where you find yourself on this spectrum, consult with your advisory team. Together, you can begin working through an exit plan, shoring up your retirement plans, or make a few minor adjustments to your investing and spending habits to mitigate the risks you’re facing.

Life is hard. I know that. But life is good. Preparing your business to sell for retirement and making adjustments to prolong your retirement can be frustrating. However, with a little preparation and planning, you can at least make it financially simple.

Are you thinking about selling your business? Do you need help with your exit planning? Are you sure your retirement funds will last? The team at Financially Simple can help with all of this and more. Reach out to us for a free consultation!