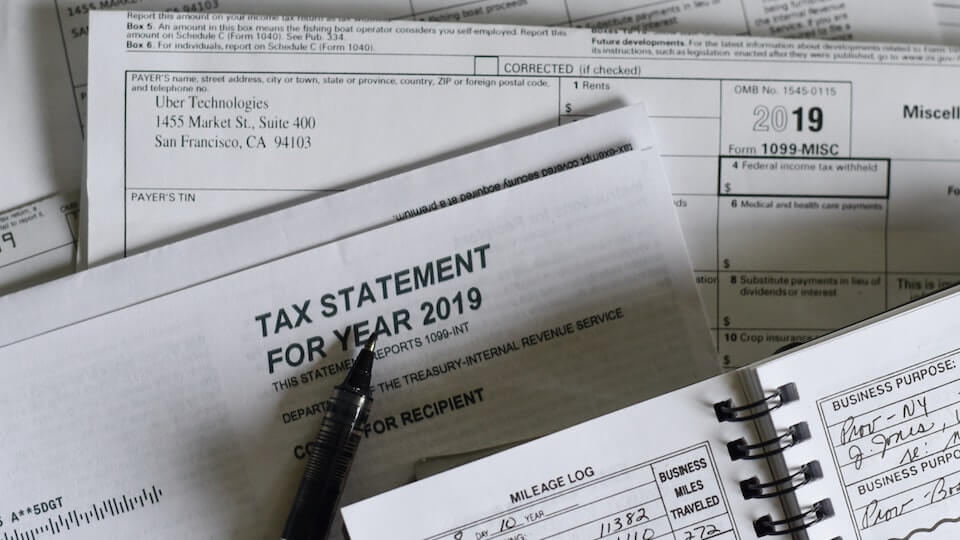

For many people, especially business owners, taxes are the primary erosion of your wealth. Taxes are a significant expense you pay from your income. However, the IRS has written an unbelievable book that gives you thousands of ways to reduce your tax liabilities. In fact, Chris Mahan, one of the principals at Mahan and Associates Tax Firm, says that “the Internal Revenue Code is the greatest wealth creation tool currently in the United States.” Sure, the Internal Revenue Code outlines what taxes you must pay. Yet, most of its content shows you ways to avoid paying taxes. So today, I want to dive into the IRC. I want to give you 49 surprising and possible tax write-offs for small business owners.