49 Surprising Small Business Tax Write Offs You Might Be Able to Take

June 21, 2019

Leasing vs Buying a Car – A Comprehensive List of the Pros & Cons

June 27, 2019Standard Mileage vs. Actual Expenses – The Pros and Cons

If you drive a personal vehicle for business use, you can choose to take the standard mileage rate deduction or you can deduct your actual vehicle expenses. Yet, which one is better? As with most things related to taxes, it’s going to depend. Therefore, let’s do an analysis. Which should a business owner choose? Actual expenses vs. mileage.

TIME INDEX:

- 00:58 – Should a Business Owner Depreciate Their Car or Take a Mileage Deduction?

- 01:21 – Standard Mileage Rate vs. Actual Expense Method

- 03:04 – Standard Mileage Rate

- 04:12 – 5 Things That You Can’t Do

- 05:01 – Actual Expense Method

- 06:03 – Can You Switch Between These Methods?

- 06:49 – Which is Best For You

- 08:15 – Guidelines to Choose The Method For Writing Off Business Expenses

- 11:35 – One Caveat

- 11:58 – Sign Off

My Own Business Vehicle

If you follow me on social media, you know that last year I was vacillating about whether or not I should purchase a new vehicle or a used vehicle. I’d run my Nissan Murano into the ground, and it was time for a new-to-me vehicle. Since I use my vehicle for business purposes, I wanted to make a wise decision. Ultimately, I ended up buying a new vehicle – a Ford F150 pick-em-up truck (as my grandma would say). I love it. Love it, love it, love it.

But now here I am, preparing my taxes. Yes, it’s June, and I’m just now preparing my taxes for 2018. I filed an extension so I could help my clients get their taxes done first. Mine will come last. Anyway, I’m finally working on my own taxes, and I’m trying to decide whether to use standard mileage vs. actual expenses. So, I’m going to go through these calculations with you. I want to show you how I made my decision and teach you how to do this yourself.

Standard Mileage Deduction Rate

In 2022, the IRS allows you to claim 58.5¢ per mile that you drive for business. Thus, you’re going to multiply the number of business miles you drive each year by 58.5¢ to determine your allowable tax deduction.

Miles Driven for Business x 58.5¢ = 2022 Standard Mileage Deduction

Let’s say, then, that you drive 1,000 miles for business in 2022. You would multiply 1,000 miles by 58.5¢ and get a deduction of $585. Not bad. If you drove 10,000 miles, that means you would get a deduction of $5,850. Even better, right?

Just remember, that 58.5¢ doesn’t grow every year. In fact, it goes down sometimes. For instance, in 2019 the mileage rate was 58¢, but in 2021 it went down to 56¢. For a look at historic mileage rates, click here.

Standard Mileage Guidelines

However, if you’re going to take the standard mileage deduction, you must follow certain guidelines.

- First and foremost, you must own or lease the vehicle. You can’t use a friend or family member’s car and claim the deduction. Uber doesn’t work, either.

- Second, you cannot operate a fleet of vehicles (five or more) and claim the mileage deduction for all of those vehicles.

- Third, you can only use a straight-line depreciation deduction on the vehicle. In other words, you must take the same deduction, year after year, over the vehicle’s useful life.

- That means that you cannot claim a Section 179 deduction on the vehicle. In other words, you cannot deduct the entire cost of the car the year you place it into service.

- Nor can you claim the special depreciation allowance on the car which allows you to deduct the entire cost of the vehicle the year you acquire it.

- And finally, you cannot have claimed actual vehicle expenses after 1997 for a car you lease.

Actual Expense Method

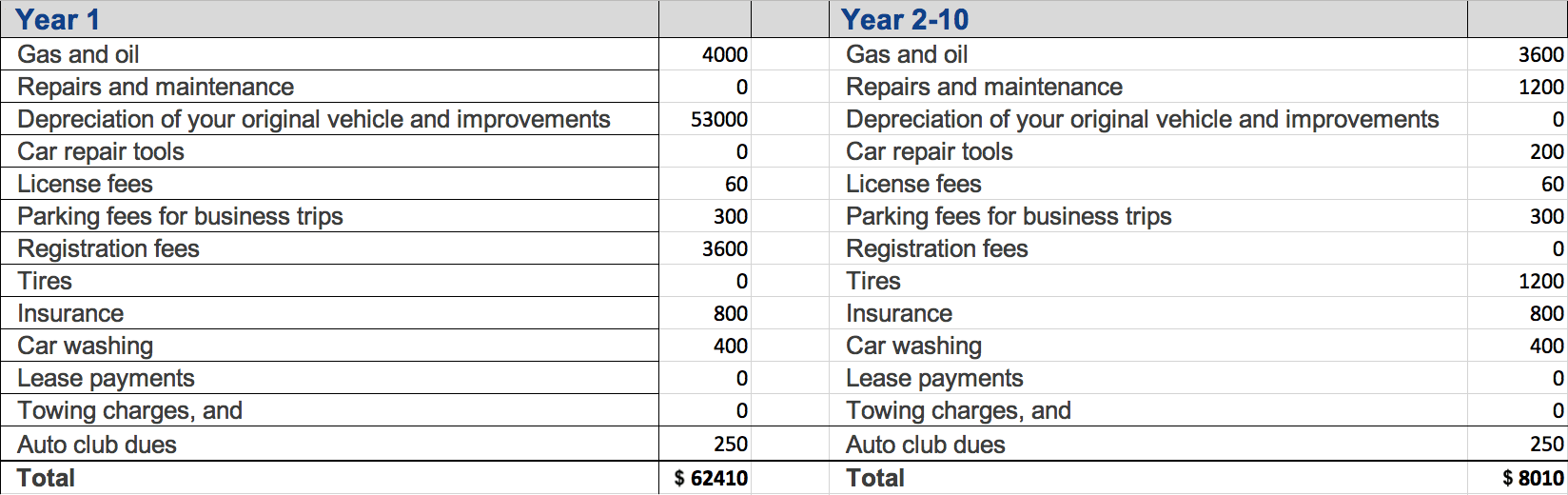

Opposite of the standard mileage rate deduction is what’s called the actual expense method deduction. To use this tax deduction, you must keep track of what it costs you to maintain and operate the car when you use it for business purposes. The IRS says that you can include costs for “gas, oil, repairs, tires, insurance, registration fees, licenses, and depreciation (or lease payments) attributable to the portion of the total miles driven that are business miles.” Thus, if you use your car for business 80% of the time you drive it, then you can count 80% of each vehicle expense as a deduction.

Standard Mileage vs Actual Expenses: Pros and Cons

Ultimately, I want to know which option will save me the most money in taxes. Isn’t that what every business owner wants? So, which is right for you? Will you get a greater tax deduction by claiming standard mileage rates or by bundling actual expenses? Let’s weigh the options, standard mileage vs. actual expenses.

Standard Mileage Rate Pros:

- It’s easy to use. – Keeping up with your mileage is fairly easy. You can keep a logbook in your car. Record all of your business mileage in the logbook. I actually keep up with my mileage on my work calendar. I record my trips, my client meetings, my business meetings, and more on my calendar. At the end of the year, I calculate how many business miles I’ve driven by looking at my calendar of events. There are also apps that can help you track mileage.

- It’s easy to calculate. – Once you know your total business mileage for the year, all you have to do is multiply that by the IRS’s rate to figure your tax deduction. That’s super simple.

- You can switch back and forth between the two methods. – Some years, I may have lots of car maintenance expenses while other years I may not. Well, IF I choose the standard mileage rate the first year I put my purchased car into service in my business, then I can switch back and forth between it and the actual expense method. However, if I count my actual expenses the first year, I must always choose that option on my taxes.

Standard Mileage Con:

- The deduction may be lower than what you would have received by doing the expense method.

Actual Expense Pros:

- Often, you receive a much larger deduction than the standard mileage rate deduction in general, especially when you factor in depreciation.

- Additionally, your deduction will probably be larger if you have a more expensive vehicle.

- And your deduction will probably be larger if you don’t drive many business miles throughout the year.

Actual Expense Cons:

- You have to keep more records. – If you don’t keep up with every little expense receipt, then you’d be better off taking the standard mileage deduction.

- You lose the ability to flip back and forth to the standard mileage rate. – If you claim actual expenses the first year you claim your vehicle as a business expense, you must always use the actual expense method.

How Do You Choose?

So I’m looking at standard mileage vs. actual expenses in my life. I’m weighing the pros and cons. Ultimately, though, it comes down to my own calculations. Here’s my thinking.

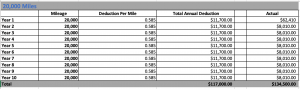

I’m predicting that I’m going to keep my new truck for about 10 years. That’s about how long I’ve kept all my other vehicles. I’m also going to assume that I’ll drive 20,000 business miles a year. IF the mileage rate stays at 58.5¢ and IF I drove 20,000 miles a year for 10 years, I would get a tax deduction of $11,700 per year. After 10 years of this, I’d have roughly $117,000 worth of deductible expenses against my taxes.

Truthfully, I don’t know for certain how much I’ll pay for vehicle care and maintenance over the next 10 years. However, since I know what type of vehicle I’m driving, I can estimate costs for fuel, oil, repairs, maintenance, depreciation, license and registration, tires, insurance, etc. Based on my calculations, my expenses will be approximately $134,000 over 10 years. Therefore, it may make more sense for me to claim actual expenses because I can generate a greater deduction over the ten-year time frame.

You can see the year by year comparison of my estimates here:

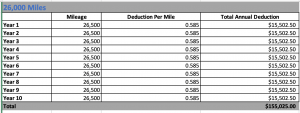

Now, if I drive more than 20,000 a year – let’s say I drive 26,500 miles a year – it may make more sense for me to take the mileage deduction because I could claim approximately $155,820 over 10 years. If the IRS raises the mileage rate up to 60¢, then I don’t even have to drive that many miles. If they lower the rate down to 47¢ or so, I’d have to drive more than 26,000 miles for that deduction to make sense for me.

I Should Do This… Except

After doing the calculations above, it looks like I should take the standard mileage deduction because I put close to 30,000 business miles on my vehicle each year. However, there’s a personal exception I haven’t figured into my calculations. In 2018, I made some money and I purchased my vehicle. I need to lower my taxable income, and I can generate a greater tax benefit to myself by deducting my actual vehicle expenses than I can by taking the standard mileage deduction.

Even though I may receive fewer tax benefits over the 10 years I plan to use my vehicle, I need the tax deduction the actual expenses will generate for me this year. I realize that if I claim the actual expenses this first year of vehicle ownership, I’ll have to claim them every year, but that’s what I’ll have to do. That’s a decision I’m making as a business owner.

Your Situation: Standard Mileage Deduction vs Actual Expenses?

You’ll have to make a decision, too. You may do your due diligence and calculate standard mileage vs. actual expenses. The numbers you total may tell you to pick one or the other. However, your personal circumstances may interfere with your calculations. You may need to expense your costs this year to lower your taxable income. Maybe you take the standard mileage rate this year and save the actual expense deduction for next year when you know you’re going to need new tires and a new transmission. If you’re unsure of what to do, talk to your tax advisor. He or she can help you navigate these muddy tax waters.

This article is part of the Cash Flow area of our ever-expanding series: Personal Finance for Business Owners. Expand your financial wealth-building by heading over today! Or simply contact us to set up a call… we would be glad to build specific plans that grow your wealth.