The Essential Leadership Qualities List for Every Small Business Owner

January 10, 2019

6 Key Differences Between Small Business Leaders and Managers

January 15, 2019How to Build Pro Forma Financial Statements That WOW Investors

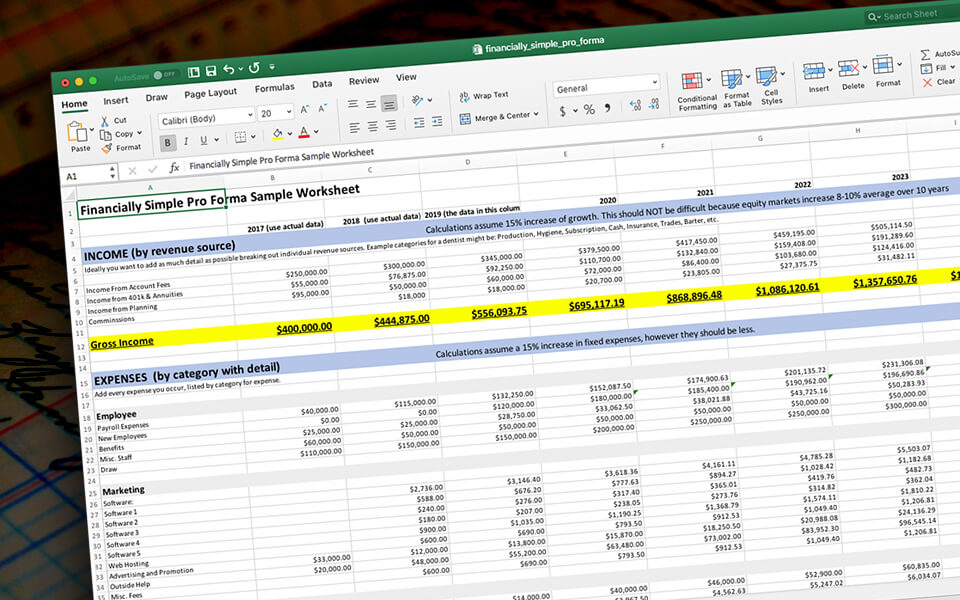

You’ve probably heard the term pro forma before, and maybe you even have an idea what it is. According to the Business Dictionary, pro formas are “assumed, forecasted, or informal information presented in advance of the actual or formal information.” That’s the basic definition, but what does that mean? In a nutshell, you’re taking historical numbers over the last few years, and you’re trying to project them forward into the future. You’re using a spreadsheet to create pro forma financial statements.

How to Build Pro Forma Financial Statements

My personal pro forma financial statement goes back five years and displays all of the income I’ve earned and the expenses I’ve incurred. Then, I’ve projected out the next 10 years of my company’s income and expenses. You don’t have to go back five years or forward 10 as I do. Maybe you show your historical trends over the past three years and forecast your numbers over the next five years. Essentially, though, your goal is to show historical patterns that predict plausible future profit margins.

So, how do you do that? Follow along with these four easy steps on how to do a pro forma financial statement.

#1 – Create a spreadsheet

- List past and future years across the top columns.

- List income and expenses down the side rows.

DOWNLOAD: Get a copy of our Pro Forma Worksheet

#2 – Total all income sources

- Create rows for every income source. Maybe, like me, you receive money from account management fees, consulting fees, financial planning fees, technology fees, etc. Perhaps, you’re in a medical field and receive income from insurance, from credit cards, from cash, etc.

- After you’ve itemized what you’ve made from each income source, total them up to determine your gross historical revenue.

- Then, predict your income growth rate for future years by multiplying your actual revenue by 2, 5, or whatever percent makes the most sense based on your historical numbers.

#3 – Total all expenses

- Create rows for every expense your company incurs. If you don’t know where to begin, look at your company’s Profit & Loss Statement and use the expenses listed there.

- After you’ve itemized what you’ve paid for each expense, total them up to determine your gross historical expenses.

- Then, predict your future expenses. If you have rental contracts or software contracts, you may be able to predict your future expenses to the penny. If you’re listing insurance expenses, employee expenses, or the like, you may want to factor in a cost of living increase of 2, 3, or 4% a year.

#4 – Determine Your Profit Margin

- Subtract your total expenses from your total income to determine your profit margin.

- Make allowances for major one-time purchases or gross expenses as necessary.

The Value of Pro Forma Financial Statements

Ultimately, you’re using your pro forma financial statements to track your company’s profit margins. You want to see if your margin is within your industry’s standards. For if you can show a significant profit margin and show how you got to that point and how you’ll keep hitting that margin, then you can ask investors or business buyers for a premium for your company.

If you have ever wondered the value of your business, both today and in the future reach out.

RELATED ARTICLE: Why would anyone buy your business? See what buyers look for.