A Business Plan: Its Effect on the Saleability of a Business – Article #3

October 19, 2017

Business Scalability…Turbocharging Your Company’s Value – Post #5

November 2, 2017Mastering Competitive Advantage… A Key to Increasing Business Value – Post #4

Thus far in my Sellable Business blog series, I’ve given you the purpose of the series, showed you why you need a quantifiable business goal, showed you what prospective business buyers will be looking for in your business, and showed you the importance of a healthy business plan in meeting your goals. You’re finally on the right track to growing and expanding your business. You’re on track to sell it. What’s next on the list to maximize in order to increase the value of your business in the eyes of prospective buyers? Let’s increase your businesses’ competitive advantage.

Podcast Time Index for “The Mastery of Competitive Advantage”

00:38 – What is Competitive Advantage

02:14 – What is Your Business’s Competitive Advantage

05:14 – How many types of Competitive Advantage are there

06:39 – The Six most common Competitive Advantages

06:51 – The People

09:08 – Organisational Culture

11:00 – Processes and Practices

13:21 – Product and Intellectual Property

14:32 – Capital and Natural Resources

15:49 – Technology

16:35 – In Conclusion

What is Competitive Advantage?

If there’s a dental practice on every other street or an optometry practice every three blocks, what makes a patient choose your office over another? Why would someone travel further, pay more, or overlook small personal inconveniences to get a routine dental cleaning or a standard eye exam at your office? What makes you special? What sets you apart from your competition? We’re talking about your competitive advantage.

In simple terms, this advantage is what makes your business better than its competition in the minds of your customers.

To me, Henry Ford is one of the most intriguing entrepreneurs of our time because of how he leveraged his company’s competitive advantage. Since the “Ford” name remains notable some 120 years after he began his business, most people believe he invented the automobile. But that’s not the case. Henry Ford didn’t invent the first car. No, he created something entirely different, and THAT is what led to his success. So what did Ford invent? The assembly line. He figured out how to physically arrange machines and people to produce more products faster than the competition. Mass production became his competitive advantage and led to his fame and fortune.

What Does This Advantage Look Like?

I read an article recently that sums up a competitive advantage. In it, Kimberly Amadeo says, “To be successful [in business], you need to be able to articulate the benefit you provide to your target market that’s better than the competition.” Exactly. You can’t blend in. You must have something or do something unique to draw customers to you right now and to entice buyers in the end.

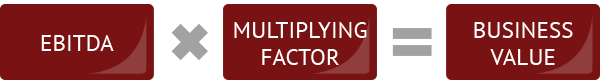

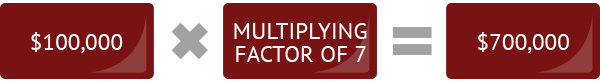

Your competitive advantage doesn’t just sell your product or service. It multiplies the value of your business. Remember our Business Value Equation from the last article?

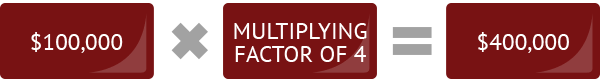

Your gross sales may be the same as your competitor’s. Your sales may be lower. But if you have a product or perform a service that no one else in the industry can provide or do, your business will be worth more than your competitor’s. For example, let’s say that you and Company B each average $100,000 gross annual sales. However, you have a patented product that Company B does not have. A business buyer will determine business growth as follows:

Company B’s Value:

Your Company’s Value:

Do you see the difference in company value? It’s not your gross sales or the present market value. No, the difference is your competitive advantage.

The Advantage in the Marketplace

I was talking with a client of mine this morning about what makes customers spend their dollars one place versus another. We spoke specifically about Chick-fil-A®. For those of you who aren’t familiar with the restaurant, it’s a fast food franchise in the Southeast that makes chicken entrees. They make one of the best chicken sandwiches I’ve ever put in my mouth. But it’s not the sandwich that sets the company apart. It’s not even their cool looking waffle fries.

So what is it? Could it be that employees say, “It’s my pleasure” when they serve you instead of asking if “you want fries with that”? Could it be their non-stop, grab-and-go drive-thru line? Well, it’s both. Chick-fil-A® secures its competitive advantage in the fast-food industry with its exceptional customer service model.

Companies like BMW and Tesla® secure their competitive advantages in the automotive industry by branding themselves as having luxurious performance. Apple and Samsung™ make their companies more valuable than others through technological innovation and marketing strategies. Pepsi® and Coca-Cola rely on brand recognition to gain and keep customers.

Technologist John Spacey wrote an article in 2015 that lists and defines 40 different types of competitive advantages businesses can have. He distinguishes niches like scalability, variety, know-how, reputation, and location. I encounter companies daily that use advantages Spacey mentions.

- Walmart® and Kentucky Fried Chicken™ have a scalable worldwide presence.

- Orvis® and Darn Tough stake their reputations on the long-lasting quality of their products.

- Walgreens and CVS Pharmacy® compete for convenience with prime real estate locations.

The Six Most Common Examples of Competitive Advantage

You should take the time to review all 40 types of advantages John Spacey identifies. We need to remain focused on our series’ goal – to make our small business a sellable asset. Let’s focus our attention on the six most common competitive marketplace advantages that marketing specialist Ana Mar outlined in 2013.

1. People:

This advantage isn’t about the number of owners, managers, or employees your company has. It’s not about your company’s gender, age, or ethnic ratios. This competitive advantage is about the loyalty of your team. I often think of Disneyland® and Walt Disney World® here.

I read a story years ago about a young family’s first visit to Disneyland®. The family stopped in front of the iconic Partners statue that depicts Walt Disney and Mickey Mouse holding hands. They saw two park employees cleaning the area, and the family asked the men how to get to a particular attraction. The laborers didn’t hand them a map or point them to a park guide. Instead, these two street sweepers slung their brooms and dustpans over their shoulders, and they escorted the family across the park to reach their destination. On the way, these men laughed and giggled with the kids, and they took some family photos for their companions. The men’s actions made such an impact on this family that the mother wrote to Disneyland® executives and said, “Your people are amazing.”

You see; one of the strongest competitive advantages a business can have is a remarkable team. If you invest in your team and include them in your vision, they will buy into your goal. They will want everyone they know to experience your product. If you get buy-in from your team, you have a rare, valuable commodity.

2. Organizational Culture:

This advantage is not so different from the first one. A company’s people show customers how to use your products or services. A successful owner will identify his individual employees’ strengths and teach his entire team to model those attitudes and behaviors. The company will streamline common expectations for its team if it excels in organizational culture.

The best example I can think of here comes from the world of sports. Football… the American pastime. Think about this. There are 50 to 100 different people on these ball teams. Each player has unique skill-sets and abilities. Each is uniquely qualified for his particular role. For the organization to win the title game, it has to make sure that the team is functioning as one, living, breathing unit instead of as 100 individuals. And if a member of the team gets hurt or isn’t pulling his weight that day, another person can slide in for the common good of the team.

Companies that create value through organizational culture do so through many months and sometimes years of intentional training. They recognize employees’ unique knowledge, skills, and abilities. Then they teach each to work in a similar way for a common goal. Together, they accomplish something greater than one alone can achieve.

3. Processes and Practices:

That brings us to number three. We’re diving down into the depths of business workings here. While many companies can make or sell related products or provide comparable services, companies can set themselves above their competition by creating unique manufacturing methods or service processes.

Let me give you an example. I grew up in the small town of Brunswick, Georgia that boasts a hole-in-the-wall restaurant called Willie’s Wee-Nee Wagon. I remember going there as a kid some 30 years ago and seeing Mr. Willie pour his life’s blood into providing good food and friendly service. Mr. Willie and his wife have passed away since then, but the establishment continues under the direction of the next generation.

Mr. Willie and his passion for good food with a friendly smile wasn’t the competitive advantage then. No, the restaurant’s pork chop sandwich is. Their chefs smother this sandwich with onions and mustard and all sorts of delicious “commonplace” ingredients. But it is the combination of ingredients, passed down by Mr. Willie, that they use in the sandwich that gives it a unique taste and presentation.

In fact, Willie’s sandwich is so deliciously unique that the company owners issue a direct challenge to their competitors on the side of the building. They declare, “If you can find a better pork chop sandwich, we’ll give you $2,000 cash.” They’ve put their money where their mouth is, and they have such a competitive advantage that no one else in that area even attempts to make or sell a pork chop sandwich.

4. Products and Intellectual Property:

Many companies utilize this fourth advantage, maybe your business included: your products that are new and innovative in design or technology. They are unique. That means you must protect your rights to that intellectual property through patents, copyrights, or trademarks.

Without legal protection, competitors can replicate your product and take away your competitive edge. Take the iPhone. Apple created a piece of technology that is very difficult to replicate. Well, Samsung™ tried, but Apple sued them and won its case, keeping its exclusivity to the product and design.

Service-based industries can still have this competitive advantage, but the logistics of it get a little trickier. I don’t have a consumable product. If Financially Simple has a product, I’d say it’s my Podcast. I’m sure that people can listen to my Podcast and record something similar, but they can’t replicate my intellectual capital. Why is that? Well, I have 38 years of different experiences in many kinds of business growth and valuation… not many have that skill set.

Other people can’t use the examples I give in my Podcast because they didn’t live them. They didn’t eat at Willie’s Wee-Nee Wagon as a child or start a landscaping company at the age of 15. Intellectual capital is inherently unique to its owner, but others can use your outlines or systems if you don’t protect your copyrights.

So if your business has a product, a system, or a design that isn’t easy for your competitors to replicate, that’s where you want to direct your focus. If you can show-off your product’s unique design or your service process, you can drive up the value of your product or intellectual property. If your product’s value increases, so does the valuation of your business.

5. Capital and Natural Resources:

Maybe you don’t have unique people, processes, products, or services. But you do have money and lots of it. Go back to Apple. That company currently has more money than many countries in the world. Their cash capital is almost impossible for others to replicate.

Perhaps you don’t have cash assets, but you do have social capital. You’ve created a good name for yourself in the Internet world. You have 200,000 followers on Twitter who are hanging on your every word. That’s a capital your competitors can’t purchase or achieve overnight. It makes your business more valuable to potential buyers.

You might own property that naturally produces resources like oil, natural gas, ore, or coal. Those natural resources can be insanely valuable.

I have a client in West Virginia who has a natural gas well on his property. Because it’s on his property, his business gets free gas usage. Free gas usage turns into energy which delivers power to machinery his company uses. That’s something that few other businesses can duplicate. My client’s business, then, has a significantly lower cost of service compared to its competitors. That drives up the value of his business. That’s the business capital that increases his company’s value.

6. Technology:

The last advantage we’ll discuss combines intellectual property and capital. Technology evolved into a powerful business asset during the Industrial Revolution at the turn of the 20th Century. Go back to Henry Ford. Many businesses, including his, were building cars. That technology was easy to duplicate. Ford set himself apart in the industry by creating the technology of the assembly line. His technological advancement decreased his product turnaround time and lowered his company costs, making him a rich and powerful man.

Technology is ever-evolving today. Every time I turn around, I see some new type of technology that boggles my mind. If your business can create new technology or technological systems that none of your competitors can easily replicate, then you have a valuable competitive asset.

So, to wrap it up…

If we’re going through this 40-day march to get our business ready to sell, and we’re trying to drive up our business’s value, one of the most important things we can do is create a competitive advantage within our industry. It increases our company’s value exponentially by increasing your value multiplier.

The concept is simple – the harder it is for your customers to leave or the harder it is for your competitors to duplicate what you do, the more valuable your business is to buyers.

So, what will we master in the next Sellable Business Series installment? We will work toward scalability… what is a scalable business and its importance in the ultimate sellability of your business.