The “Why” I Wrote the Building a Sellable Business Series

October 5, 2017

A Business Plan: Its Effect on the Saleability of a Business – Article #3

October 19, 2017Selling Your Business 101 – The Financially Simple Guide

In my introduction to this blog & podcast series, I told you that my goal for this series is to walk you through the journey of starting, building, and ultimately selling a business. And now right off the bat, I’m going to talk to you about selling your business? Hold up. Isn’t that a little strange talking about the end before we even start? Well, yeah, but hear me out.

Follow Along With The Financially Simple Bizcast:

Podcast Time Index for “Planning the Sale of Your Business by Starting at the End”

- 01:20 – Start with a Plan

- 03:34 – Statistics on Small Business Sales

- 06:38 – Know How to Sell before You Start

- 08:40 – What is Value Acceleration

- 11:57 – What does Value Acceleration do for Your Business

- 16:35 – Getting Started

- 21:46 – The Four Cs

Before Make the Commitment, You MUST Understand…

According to the Exit Planning Institute, or the EPI, 80% of companies below 50 million dollars in revenue never sell. 80%! That’s crazy!

How about this revelation? 75% of the business owners who do sell aren’t even happy that they sold their business. Yet, three out of four companies will be changing ownership in the next ten years. Wait a minute. Why are 75% of businesses changing ownership so soon? Well, the Baby Boomers who wanted to sell or get out of business years ago ran into the economic collapse of 2007 and 2008. They couldn’t get out profitably then, so they’ve been holding onto their companies until they could recuperate a profit or until they’re just too old to continue.

Why are business exit numbers so dismal? What is happening between a company’s beginning and its end to make it unsellable? Here’s the problem with that. 80% of business owners’ net worth is tied up in their business. Let’s think about this for a second. If you’re a business owner, 80% of your net worth is tied up in an asset that is only 20% likely to sell in the end.

How does that make you feel? I don’t know about you, but I don’t want to be in the 80% of owners out there who start a business, put their entire life’s assets into the business, bust their butts growing that business, and then walk away from the business without being able to sell it. That’s like having a rental property that provides you with monthly money, but you can’t ever sell the house and get its equity. It’s like having a dividend stock or CD that provides you with an income, but you never own the asset. The asset isn’t worth anything other than the monthly dividend earned from it. Yet, that’s where 80% of our business owners are today.

You MUST Start Thinking About Your Business as a Sellable Asset NOW!

So you may be wondering why you need to know how to sell your business if you don’t plan on selling it anytime soon. Well, I often hear people say, “10 years and out.” I call it a 10 and Out Plan. In fact, I recently finished my first book that adds to this blog series explaining how to build a business and sell it within ten years. Now I’m 40-years-old folks, and I’m probably not going to sell my company when I’m 50. But if I understand what led to the success of the 20% of business owners who sold their companies as a valuable commodity, wouldn’t I want to model my own business in a similar fashion? In my view, you should begin everything with the end in mind. I want to build a business that can sell for profit. I want you to do the same.

So what makes one business more valuable to buyers than another? How do buyers calculate the value of a business they want to buy? If I understand the answers to those questions, then I understand what I need to do in my business today to sell it in the future.

NEW: The Ultimate Sale – Justin’s book teaches you what “best in class” businesses do to get maximum $$ when they sell. Grab a copy today!

What Do Business Buyers Find Attractive?

In his book Walking to Destiny (2016), Chris Snider gives business owners an outlined plan to prepare their companies for sale. Chris often tells audiences that driving the value of their businesses up will simultaneously increase their net income. Increased value plus increased income are primary ways to increase profit during the sale of the business.

Chris actually coins the term “Value Acceleration” in his book. He defines Value Acceleration as a proven process that focuses on value growth through the alignment of business, personal, and financial goals. In my words, Value Acceleration is when business owners purposely design and build a business that other people want to buy. I don’t know about you, but I don’t want to spend my entire life working on an asset that no one wants. Why should my business be valuable only to me? Sure, my business may provide me with a decent lifestyle; it may give me some freedom, but that’s not enough. I want to build an asset that I can sell to a strategic buyer, like my children or my employees, or that I can sell to another interested entity.

So what are people who buy businesses looking for? What characteristics do enterprises have that make them attractive to potential buyers? Tons and tons! I could give you a list of 50-100 things that make the acquisition of a business desirable to investors. Inevitably, though, the following four business attributes appear at the top of every buyer’s wish list:

Top 4 Characteristics that Make a Business Valuable to Buyers

- Is it profitable? Does your business make significant net income?

- Is it competitive? Is your business beating the competition?

- Is it scalable? Can your business grow or downsize quickly to withstand ebbs and flows in demand?

- Is it sustainable? Can your business withstand economic and personal storms?

How does this help us? Well, we’ve discussed the importance of creating and running a business with its end goal in mind. If our ultimate goal is selling our business and living off of its proceeds, then we must know how to make our company valuable. If buyers look for profit, competitive advantage, scalability, and sustainability, we’ve just created our business blueprint. Or, if you will, we’ve mapped out four states we have to drive through to get to our final destination.

How Do Buyers Calculate My Business’s Value?

Now that we know what makes our business sellable or valuable to buyers, how then do we multiply our business’s worth today to sell it for the maximum amount of money possible in the future?

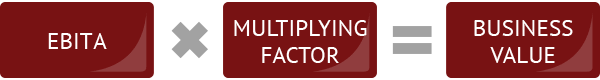

Let’s go back to what is value, and how do you determine it? It’s a simple calculation. Business valuators would argue with me and say that I’m over-simplifying a complex calculation matrix, but that’s why I call my company Financially Simple! Let’s make this easy:

Business Valuation Equation

What does this mean? Let’s say that our Earnings Before Interest Taxes and Amortization (EBITA) is $100,000. And let’s say our multiple factor is between 3 and 7:

$100,000 x 3 = $300,000

$100,000 x 7 = $700,000

So, in this example, our business is worth between $300,000 and $700,000 to potential buyers. How, then, do we sell our company for $600,000 or $700,000 instead of settling for $300,000 or $400,000? Here is where we business owners control our own destiny.

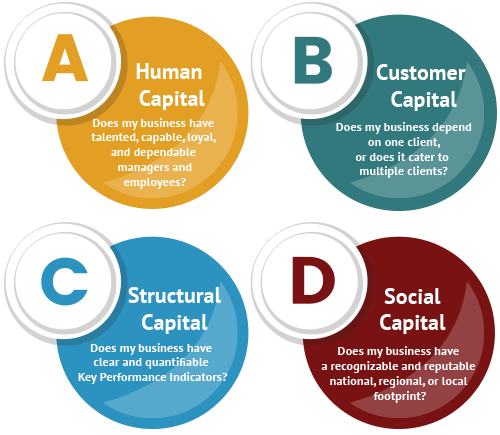

Again, Chris explains that “capital” has a huge effect on the multiple. Now I already hear you thinking, “Of course it does, Justin. The amount of money my business makes, or my capital, is its value.” Not quite. The amount of money your business makes is “GROSS SALES” in the equation above. This capital is the “UNKNOWN MULTIPLIER,” and it comes in four different forms:

The Four C’s of Business Capital

The strength of these Four C’s, if you will, determines the value buyers recognize in your business.

How Do I Make My Business Profitable, Competitive, Scalable, and Sustainable?

As we’ve talked about, Value Acceleration is a proven process that focuses on value growth by aligning business, personal, and financial goals. Essentially, it creates a roadmap to success.

Before we can focus on growing value within our business, though, we small business owners must recognize that value already exists within our company. Your business meets a customer’s need. You provide a service or a product that people have to have. That’s valuable. You’ve already identified a need in the market that your competitors haven’t met, and you’ve seen the profit that can come from meeting that need. Over time, you’ve put together a team of people to help you reach your target market and take care of your consumers once they find you. You’ve even purchased insurance plans and the like to make sure that your company can weather storms. Your business, therefore, has value.

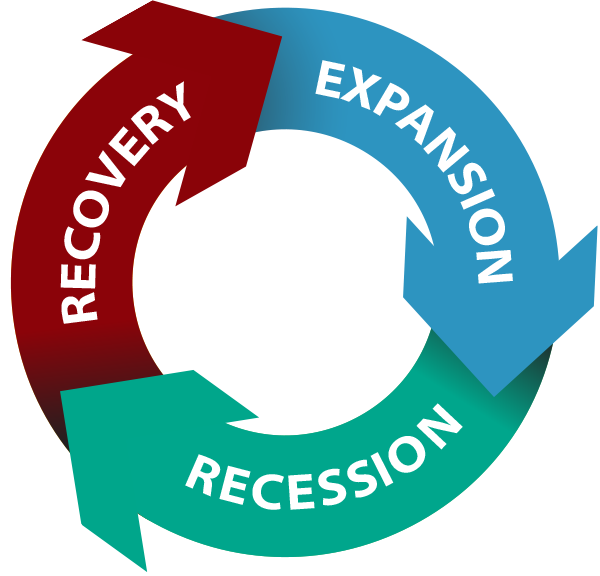

Your business’s value exists when you open your company’s doors, and it exists within every cycle of your business’s life. Just like the national economic market, you’re going to experience expansion; you’re going to experience contraction. You’ll go through cyclical periods of recession, recovery, and expansion throughout the entire life of your business. Worth exists throughout those cycles, but the amount of your business’s value will rise and fall according to what period of the cycle you are in. However, you as a business owner determine the severity of value loss or the significance of value gain over the life of your business.

Successful business owners identify what their business is worth at all times, and they determine the worth they want their company to have. They keep that value goal at the top of their minds all the time. They have an end worth in mind.

How Do I Maximize My Business’s Capital?

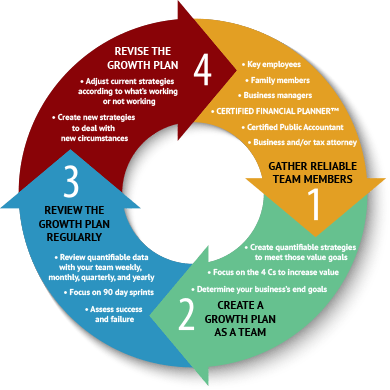

Successful entrepreneurs know their current worth and their goal worth, but more importantly, they take active steps to reach those goals. They have a systematic approach to identify, protect, and build their value. They don’t just wake up every morning and go through the motions. No. They make a detailed, written, systemized plan to increase their company’s capital value, and they’re relentless at following that plan. These value creators work on their business instead of working in their business.

Following the Value Acceleration process, business owners that create sellable businesses maximize their 4 C’s value (their capital) by doing the following things:

Steps Business Owners Take to Maximize Capital

If business owners follow this process, the timing of their business sale becomes irrelevant. They’re driving the intrinsic value of the company higher weekly, monthly, quarterly, and yearly. Because they’re focused on growing their business to sell it for maximum profit, their company’s value is increasing despite economic recession or progression.

So let’s get to the end. I don’t care if you’re just starting your business from scratch or if you’ve been in business 20 years. Knowing where you want to be in the end provides you with a roadmap to get to the end, and knowing how to reach the end is necessary to get to the end in style.

Next steps?

If you want to learn the full process you can continue with the next article in this series: the value of your business plan. Or, simply give us a call to learn how our team of Business Value Growth experts will mentor you through growing and preparing your business for its eventual sale.