August 2, 2022

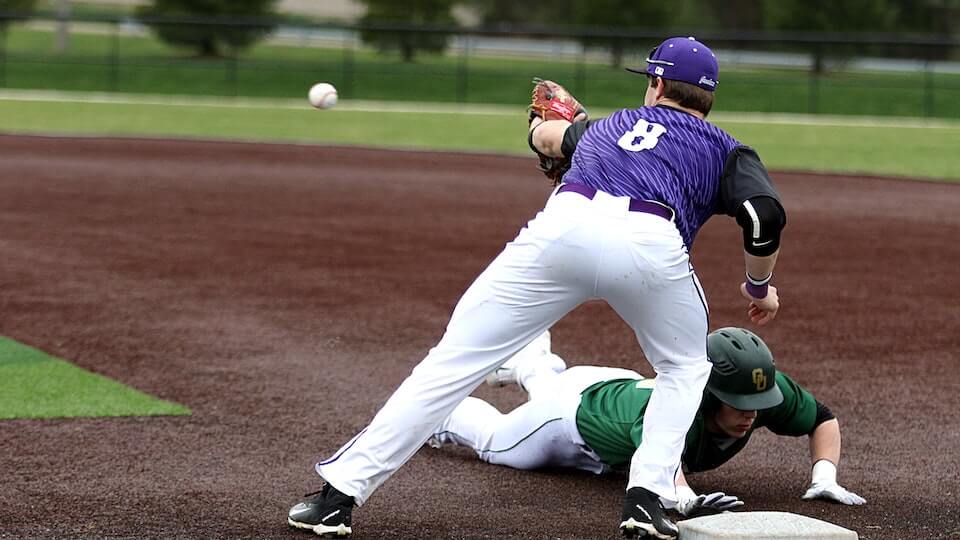

Whether you realize it or not, we’re all playing the wealth game. Some never get off of first base while others do quite well for themselves on second and find financial freedom on third. But today, I want to talk about those of you who have won the game. You’ve rounded all of the bases and now find yourselves safe at home plate. So, join me as I wrap this series up with a look at what it means to truly win the wealth game.